Maintaining its equilibrium above the $1,915 threshold, the gold price charts a steady course in the Asian session, initiating the week on a cautious note. A nuanced narrative unfolds as the XAU/USD pair hovers around the $1,916 mark, registering a fractional uptick of under 0.10% for the day. Nevertheless, this tempered ascendancy remains juxtaposed against a recent two-week pinnacle attained last Thursday, revealing a market that teeters on the edge of decisive action.

The US Dollar (USD) welcomes the new week with a discernible softening, diverging from its zenith since early June. This shift assumes significance, projecting a salient undercurrent that favors the gold price. A weakened USD traditionally augments the value of USD-denominated commodities, gold included. This dynamic, however, is met with a countervailing force in the form of prospective policy tightening by the Federal Reserve (Fed). This pragmatic restraint is conspicuous, deterring traders from plunging headlong into exuberant bullish speculations surrounding the yield-less allure of gold. Consequently, the tenuous balance constrains any further surges, at least for the interim.

During a keynote speech at the Jackson Hole Symposium, the custodian of the Federal Reserve, Jerome Powell, delivered insights that reverberated through the financial echelons. Powell’s assertion that a further elevation of interest rates might be necessary to curb inflation resonated, injecting a note of circumspection into the markets. This deliberation underscores the Fed’s nuanced approach, emphasizing the need to tread cautiously between tightening and holding the interest rate steady. This calculated articulation reinforces prevailing bets that foresee another 25 basis point escalation by the year’s culmination. Such a trajectory bolsters the yield profile of US Treasury bonds, thereby shoring up the fortifications around the USD.

Parallel to this complex tapestry of market forces, the announcement of China’s novel initiatives over the weekend kindles a risk-appetite that may, in turn, constrict the gold price’s haven status. Of particular interest is China’s decision to recalibrate its stamp duty on stock trading, an action aimed at invigorating a waning market and resuscitating investor sentiment. These measures entail a reduction in the stock trading levy, retreating from 0.1% to 0.05%, effective August 28. This strategic recalibration, the first since 2008, infuses a distinctly positive tenor into the equity markets. This exuberance, however, interposes itself as a potential impediment to bullish sentiments around the XAU/USD pair.

Striding forward, the impending release of pertinent economic data from the US on Monday beckons attention. Notably absent from the roster of potentially pivotal indicators, this day leaves the gold price beholden to the ebbs and flows of USD price dynamics and the broader temperament of risk. However, it is conceivable that a pronounced directional shift could be constrained, pending the unveiling of consequential US macroeconomic releases slated for later in the week. Foremost among these is the eagerly anticipated Non-Farm Payrolls (NFP) report due on Friday. This prelude imparts a sense of prudence, urging market participants to refrain from committing to sweeping trajectories until resolute and resounding buying patterns assert themselves. This restraint is especially germane in the context of the recent substantial resurgence from the $1,885 echelons – a nadir last witnessed on March 13.

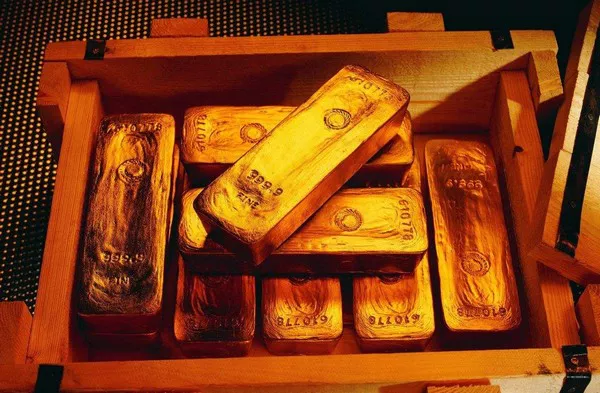

In the grand tapestry of financial markets, gold continues to exert its gravitational pull as a lustrous haven. Amidst the intricate interplay of USD dynamics, monetary policy nuance, and global market sentiment, the gold price navigates an enigmatic course. The steady tethering above the $1,915 milestone signals a market that braces for impact, a poised equilibrium that holds within it the potential for profound action. As the world watches, the stage remains set for an unfolding drama, with each twist and turn setting the tone for a narrative that embraces both unpredictability and calculated calculation. In this intricate dance, the gold price emerges as both participant and arbitrator, defying facile prediction while adhering to the time-honored rhythms of market sentiment.