Gold has long been considered a safe-haven asset and a store of value. Investors have traditionally turned to gold during times of economic uncertainty and as a hedge against inflation. While it’s commonly viewed as a long-term investment, some individuals may wonder if physical gold is a suitable option for short-term trading. In this article, we’ll explore the characteristics of physical gold as an investment, the challenges of short-term trading, and whether it can be a viable strategy.

1. The Appeal of Physical Gold

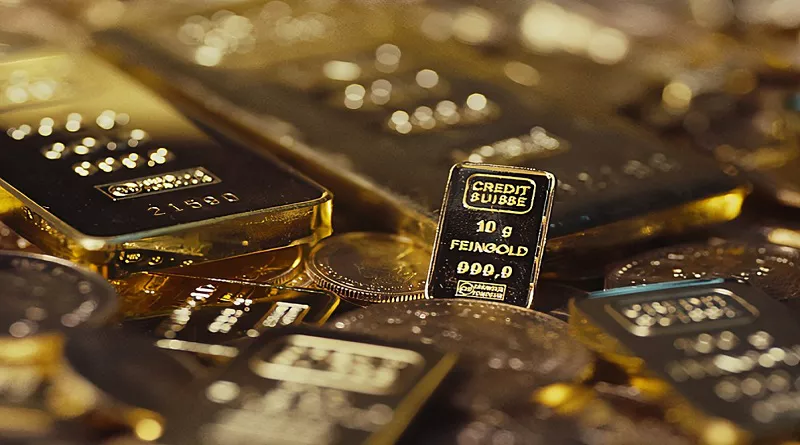

Physical gold, typically in the form of coins or bars, offers several advantages as an investment:

Tangible Asset: Unlike stocks or bonds, physical gold is a tangible asset you can hold. This can provide a sense of security, as you physically possess your investment.

Liquidity: Gold is highly liquid and widely recognized, making it relatively easy to buy or sell in the market.

Portfolio Diversification: Gold can act as a diversification tool in an investment portfolio, potentially reducing overall risk.

Inflation Hedge: Many investors turn to gold as a hedge against inflation, as its value often increases during periods of rising prices.

2. Challenges of Short-Term Trading in Gold

While physical gold has its merits, short-term trading presents unique challenges:

Volatility: The gold market can be volatile, with prices subject to rapid fluctuations. Short-term traders must navigate these price swings, which can result in gains or losses.

Transaction Costs: Buying and selling physical gold often involves transaction costs, such as dealer fees and storage expenses. Frequent trading can erode profits.

Market Timing: Successfully trading gold in the short term requires accurate market timing, which is notoriously difficult. Even experienced traders can struggle to predict short-term price movements.

Tax Implications: Depending on your location, short-term gains from gold trading may be subject to higher tax rates than long-term gains, affecting your overall returns.

3. Is Short-Term Trading in Physical Gold Viable?

Whether short-term trading in physical gold is viable depends on your investment goals, risk tolerance, and trading expertise. Here are some considerations:

Expertise: Successful short-term trading in gold demands a deep understanding of market dynamics, technical analysis, and a reliable trading strategy.

Risk Tolerance: Short-term trading can be high-risk, and losses are possible. Assess your risk tolerance and only trade with capital you can afford to lose.

Strategy: Develop a well-thought-out trading strategy that includes entry and exit points, stop-loss orders, and risk management techniques.

Costs: Be aware of transaction costs and factor them into your trading plan. Frequent trading can eat into profits.

Diversification: Avoid putting all your investments into short-term gold trading. Diversify your portfolio to spread risk.

FAQs About Short-Term Trading in Physical Gold

1. How do I start short-term trading in physical gold?

To start, educate yourself about the gold market, develop a trading plan, and consider working with a reputable broker or dealer.

2. What is the typical holding period for short-term gold trading?

Short-term trading in gold can range from minutes to several weeks or months. The holding period depends on your trading strategy and market conditions.

3. Are there alternative ways to trade gold without holding physical assets?

Yes, you can trade gold through various financial instruments, such as gold futures, exchange-traded funds (ETFs), or gold mining stocks, which don’t require physical ownership.

4. Is short-term gold trading suitable for beginners?

Short-term trading can be challenging for beginners due to its complexities and risks. It’s advisable to gain experience with longer-term investments before attempting short-term trading.

5. What are the tax implications of short-term gold trading?

Tax regulations on short-term gold trading vary by country. Consult with a tax professional to understand the specific tax treatment in your jurisdiction.

In conclusion, short-term trading in physical gold can be viable for some investors, but it comes with significant challenges and risks. Success in this arena requires a deep understanding of the gold market, effective trading strategies, and a tolerance for volatility. Before embarking on short-term gold trading, carefully consider your investment goals, risk tolerance, and level of expertise, and be prepared for both potential gains and losses in the pursuit of short-term profits.