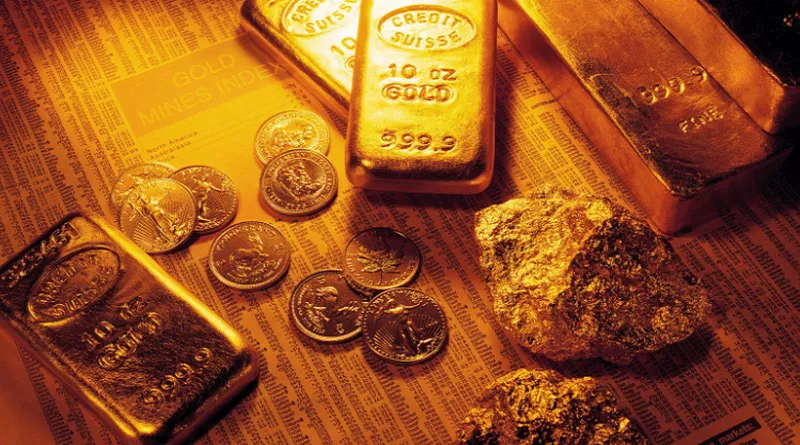

Intensifying conflicts in the Middle East, coupled with the looming visit of the U.S. President to Israel, have cast a shadow over the global market sentiment. This has propelled gold and oil prices upwards as investors seek safe-haven assets amid geopolitical uncertainties. Meanwhile, the Dollar Index showcased resilience despite dovish expectations from the Federal Reserve, supported by positive retail sales figures.

In the wake of these developments, U.S. equity markets adopted a cautious approach, anticipating a potential interest rate hike in December. Japan’s bond yields surged to a level unseen since 2013, raising concerns about possible intervention by Japanese authorities.

The meeting between Chinese President Xi Jinping and Russia’s Vladimir Putin is expected to influence the trajectory of the Middle East conflict, which further impacts the movement of gold prices.

On the other hand, the EUR/USD pair faced resistance due to strong U.S. economic data, with attention now turning to the Eurozone’s CPI data for further market direction. The USD/JPY pair witnessed significant weakness, prompting vigilance for potential Japanese intervention.

In the realm of stocks, the Dow Jones experienced a surge following robust economic data, while concerns over trade tensions between the U.S. and China loomed large. Investors are closely observing corporate earnings reports for cues on the future direction of the market.

The GBP/USD pair remained in an asymmetric triangle pattern, reflecting the uncertainty and indecision in the market, while the Australian dollar held its ground against the strong USD, backed by the RBA’s hawkish September Meeting Minutes and China’s robust GDP figures.

The oil market maintained a relatively steady position, influenced by U.S. diplomatic efforts and the potential relaxation of sanctions against Venezuela.

As tensions in the Middle East continue to unfold, the global financial landscape remains on edge, with investors closely monitoring geopolitical developments and economic indicators for insights into future market movements.