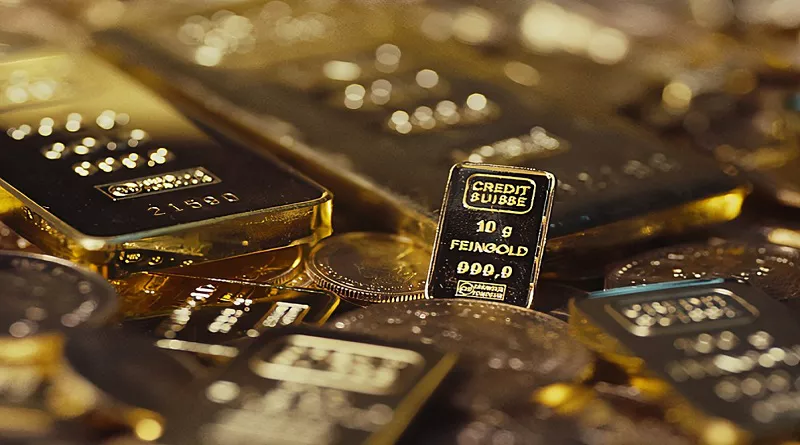

The spot gold market stands at the intersection of tradition, economic significance, and contemporary financial markets. As a precious metal with enduring value, gold has captivated investors and traders for centuries. In this comprehensive guide, we delve into the dynamics of the spot gold market, providing an overview, exploring the latest news shaping the industry, and offering insights into the analysis from the world’s top financial markets.

1. Understanding the Spot Gold Market

1.1 What Is the Spot Gold Market?

The spot gold market is where gold is bought and sold for immediate delivery and settlement. Unlike futures contracts, spot transactions involve the physical exchange of gold. Market participants include central banks, institutional investors, retail traders, and jewelry manufacturers, contributing to the market’s liquidity and diversity.

1.2 Key Features of Spot Gold Trading

Spot Prices: The central feature of the spot gold market is the determination of real-time prices based on supply and demand dynamics.

Physical Delivery: Spot transactions involve the actual exchange of gold, making it distinct from derivative instruments like gold futures.

Global Presence: The spot gold market operates globally, with major hubs in London, New York, and Zurich.

2. Spot Gold Market Overview

2.1 Market Participants

Central Banks: Central banks hold significant gold reserves as part of their monetary policy and foreign exchange reserves.

Investors: Institutional and retail investors engage in spot gold trading for portfolio diversification and as a hedge against economic uncertainties.

Jewelry Industry: The jewelry industry relies on the spot gold market for sourcing raw material.

2.2 Market Influencers

Economic Conditions: Economic indicators, inflation rates, and interest rates influence gold prices.

Geopolitical Events: Political instability, conflicts, and trade tensions can create volatility in the spot gold market.

Market Sentiment: Investor perception of risk and economic conditions shapes market sentiment.

3. Spot Gold Market News and Analysis

3.1 Financial News Outlets

Major financial news outlets, including Bloomberg, CNBC, and Reuters, provide real-time updates on spot gold prices, market trends, and analysis. These outlets offer valuable insights for investors and traders looking to stay informed about the latest developments.

3.2 Analysis from Financial Markets

Technical Analysis: Traders use charts, indicators, and patterns to analyze historical price movements and identify potential future trends.

Fundamental Analysis: Examining economic factors, geopolitical events, and central bank policies helps forecast gold price movements.

3.3 Market Reports

Financial institutions and research organizations release market reports providing in-depth analysis of spot gold trends. These reports cover supply and demand dynamics, central bank activity, and macroeconomic factors influencing the market.

4. Spot Gold Market FAQs

1. How are spot gold prices determined?

Spot gold prices are determined by the forces of supply and demand in the market. Factors such as economic conditions, geopolitical events, and investor sentiment contribute to price discovery.

2. Can individuals buy and sell gold in the spot market?

While central banks and large institutions dominate the spot gold market, individuals can indirectly participate through financial instruments like gold ETFs or by purchasing physical gold from dealers.

3. What is the role of central banks in the spot gold market?

Central banks play a crucial role in the spot gold market by holding significant gold reserves. These reserves provide stability, support monetary policy objectives, and act as a store of value.

4. How does the spot gold market differ from the futures market?

In the spot gold market, transactions involve the immediate exchange of physical gold. In contrast, the futures market involves contracts for the future delivery of gold, providing a way for traders to speculate on future price movements.

5. What impact do interest rates have on the spot gold market?

Interest rates can influence the opportunity cost of holding gold. When interest rates are low, the appeal of non-interest-bearing assets like gold may increase, potentially affecting demand and prices in the spot gold market.

In conclusion, the spot gold market remains a cornerstone of the global financial landscape, embodying the rich history and economic significance of gold. Whether you are a seasoned investor, trader, or someone curious about the dynamics of this market, understanding the spot gold market’s fundamentals, staying updated with the latest news, and analyzing trends are essential. The interplay of economic factors, geopolitical events, and market sentiment makes the spot gold market a dynamic and fascinating arena for financial engagement.