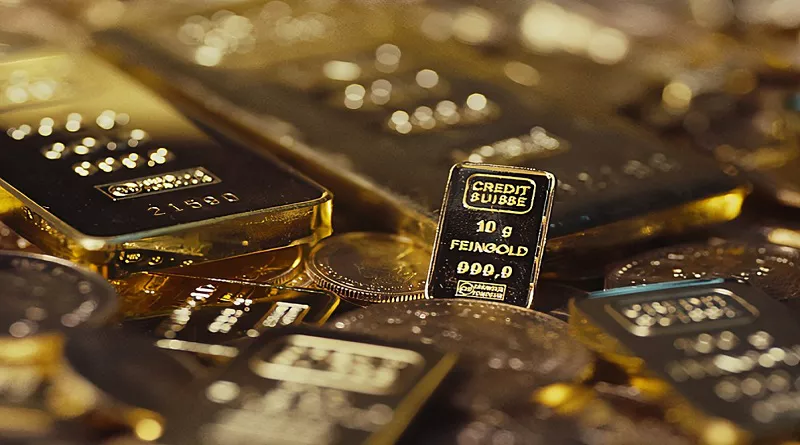

On November 6, spot gold prices plummeted below $2700 per ounce for the first time since October 18, marking a notable shift in the precious metals market. The price saw a sharp drop of 1.61%, signaling heightened volatility and a change in investor behavior. This latest movement in gold prices underscores the ongoing unpredictability of global economic conditions and the shifting dynamics of safe-haven investments.

Key Factors Behind the Decline in Gold Prices

The recent fall in gold prices can be attributed to a confluence of economic factors that are shaping the global financial landscape. Investors are closely monitoring a range of issues that have the potential to influence market trends, including inflation rates, fluctuations in currency values, and geopolitical instability. As a traditional safe-haven asset, gold often responds to these variables, with demand increasing during times of uncertainty.

However, in the current environment, these factors seem to be pushing the market in a different direction. A rising number of economic challenges, including inflation concerns and the fluctuating value of major currencies, have prompted investors to reconsider the role of gold in their portfolios. Furthermore, shifting monetary policies and interest rate changes by central banks around the world have led to a reevaluation of gold’s attractiveness as a stable investment.

Interest Rates and Monetary Policies Impacting Gold’s Appeal

Central banks’ decisions regarding interest rates and monetary policies play a critical role in shaping investor sentiment towards gold. Historically, when interest rates rise, gold’s appeal as an investment tends to wane. This is because higher interest rates make yield-bearing assets like bonds and savings accounts more attractive, reducing the demand for non-yielding assets such as gold.

In recent months, global central banks have adopted a more hawkish stance, raising interest rates to combat persistent inflation. These policy adjustments are seen as an attempt to stabilize economies but have also contributed to a reduction in gold’s appeal as a hedge against inflation. As investors seek higher returns elsewhere, gold has faced downward pressure, contributing to its recent price decline.

Geopolitical Tensions and Currency Fluctuations Add to Market Uncertainty

In addition to economic indicators, geopolitical tensions continue to play a significant role in influencing market behavior. The unpredictable nature of global politics often drives investors towards gold as a safe-haven asset during periods of heightened instability. However, recent geopolitical events, such as trade disputes, conflicts, and shifts in international alliances, have contributed to a complex and volatile market environment.

Currency fluctuations also add another layer of uncertainty. The strength of the U.S. dollar, in particular, has a significant inverse relationship with gold prices. As the dollar strengthens, gold tends to weaken, as the precious metal becomes more expensive for foreign investors holding other currencies. The recent strengthening of the dollar has, therefore, exerted downward pressure on gold prices, further complicating the outlook for the precious metal.

Analysts Predict Continued Volatility for Gold Prices

Market analysts are closely watching the unfolding economic landscape, as upcoming data releases and central bank announcements could provide further insight into the direction of gold prices. Some analysts believe the current downward trend could persist, particularly if inflationary pressures remain under control and interest rates continue to rise.

Gold has long been seen as a hedge against inflation, a store of value during economic downturns, and a safe-haven investment during periods of geopolitical unrest. However, with the evolving economic landscape and changes in central bank policies, the traditional role of gold is being challenged. As global markets continue to shift, gold’s ability to retain its safe-haven status will likely be tested.

The future of gold prices will largely depend on key factors such as the trajectory of inflation, central bank actions, and the overall state of the global economy. As more economic data becomes available in the coming months, it will be crucial for investors to stay informed and adapt their strategies accordingly.

Investor Caution and the Need for Strategic Portfolio Management

Given the current volatility in the gold market, investors are advised to proceed with caution. While gold remains a critical component of many portfolios as a hedge against market downturns, its recent decline serves as a reminder of the risks associated with investing in commodities. Diversifying investment portfolios and staying attuned to global economic developments will be crucial for managing risk and seizing potential opportunities.

The gold market’s recent decline highlights the importance of maintaining flexibility in investment strategies. Investors should be mindful of the broader economic environment and remain prepared to adjust their positions in response to changes in central bank policies, currency movements, and geopolitical events. As always, a balanced approach that takes into account both potential risks and rewards is essential in navigating the complex world of gold investments.

Conclusion: A Complex Outlook for Gold Prices

The drop in spot gold prices below $2700 per ounce is a reflection of the ongoing volatility and shifting dynamics within the global economy. A combination of rising interest rates, geopolitical uncertainty, and currency fluctuations has led to changes in investor sentiment, impacting the demand for gold as a safe-haven asset.

As the market continues to evolve, gold’s role as a store of value and inflation hedge may be tested, and further price fluctuations are likely. For investors, staying informed about economic developments and adjusting strategies to reflect changing conditions will be essential for managing risk and capitalizing on opportunities in the gold market.

The future of gold prices remains uncertain, but with careful analysis and strategic planning, investors can navigate the challenges posed by the current market environment.

Related topics: