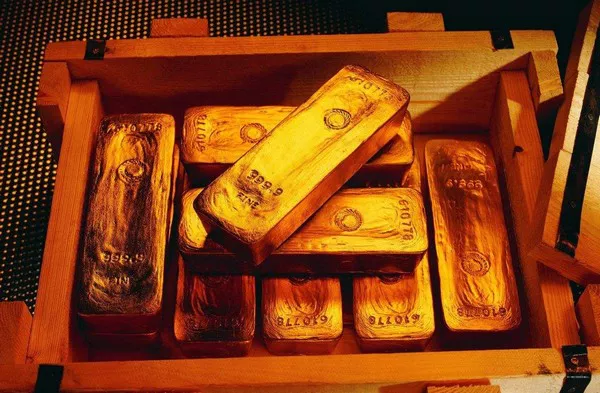

Gold prices slipped on Thursday as investors adopted a cautious approach, awaiting key U.S. labor market data that could provide insights into the Federal Reserve’s future interest rate decisions. The market’s attention was firmly fixed on the upcoming U.S. non-farm payrolls (NFP) report, set to be released on Friday, which could influence the central bank’s stance on monetary policy.

Gold Prices Slip Amid Economic Data Watch

As of 0848 GMT, spot gold was trading at $2,645.02 per ounce, marking a 0.2% decline. U.S. gold futures also saw a similar dip, edging lower by 0.2% to $2,669.70 per ounce. The price movements reflected a market in wait-and-see mode, with investors holding back from making significant moves ahead of the release of crucial economic data later in the week.

The primary focus for market participants was the U.S. job market, with initial jobless claims scheduled for release later on Thursday, followed by the highly anticipated NFP data on Friday. Analysts are expecting the U.S. economy to have added 200,000 jobs in November, a significant rebound from October’s surprisingly low gain of just 12,000 jobs.

NFP Data Could Determine Fed’s Next Move

According to Ole Hansen, head of commodity strategy at Saxo Bank, a robust jobs report is largely priced into the market. However, he suggested that a weaker-than-expected NFP report could provide some support for gold prices. “If we see weakness in the report, it could add some support to gold prices as the market is pricing in that the U.S. economy is doing quite well,” Hansen explained.

The market has been largely optimistic about the U.S. economy, but signs of a softening labor market could lead to more cautious expectations about the Federal Reserve’s future actions. Investors are currently anticipating a 75% chance of a 25-basis-point rate cut at the Federal Reserve’s meeting scheduled for mid-December, according to data from the CME Group’s FedWatch Tool.

Fed’s Recent Remarks Fuel Speculation

Recent comments from Federal Reserve officials also contributed to market uncertainty. On Wednesday, Fed Chair Jerome Powell indicated that the U.S. economy is performing stronger than expected, which led to suggestions that the central bank might take a more cautious approach toward cutting interest rates. Powell’s remarks were echoed by Mary Daly, President of the San Francisco Federal Reserve Bank, who stated that there is no immediate need to reduce rates.

These comments have led to a shift in expectations about the Fed’s monetary policy trajectory, with many now questioning the likelihood of further rate cuts in the near term. Since gold is a non-yielding asset, it tends to perform better in low-interest rate environments, making it sensitive to changes in interest rate policy.

Interest Rate Decisions and Gold’s Outlook

ANZ Bank analysts cautioned that if the Fed refrains from cutting rates at the December meeting, it could lead to further selling in gold as speculative positions unwind. “If the Fed skips its interest rate cut in the December meeting, this could trigger a further sell-off in elevated speculative positions, dragging gold prices lower,” the analysts noted in a recent report.

Gold’s recent price movements reflect this uncertainty, with traders weighing the potential impact of both a stronger economy and the Fed’s rate decisions on the precious metal’s performance. Gold, which has long been seen as a safe haven during times of economic uncertainty, may struggle to maintain its upward momentum if market expectations for rate cuts begin to fade.

Other Precious Metals See Mixed Performance

Meanwhile, other precious metals saw a mixed performance on Thursday. Spot silver fell 0.2% to $31.24 per ounce, continuing its downtrend from earlier in the week. On the other hand, platinum and palladium posted gains. Platinum rose by 0.7%, reaching $947.90 per ounce, while palladium gained 0.5%, trading at $982.73 per ounce.

The rise in platinum prices comes amid continued concerns about palladium’s market dynamics. As demand for palladium, a key component in automotive catalysts, shifts toward platinum, analysts expect the trend to persist through 2026. “Auto catalyst demand substitution from palladium to platinum has been the key headwind for palladium and is likely to continue into 2026,” ANZ added.

Market Dynamics Ahead of Year-End

Looking ahead, market participants are expected to remain cautious as the year-end approaches, with many taking profits or adjusting positions in anticipation of potential volatility. Hansen noted that big decisions are unlikely to be made at this stage, with most activity being driven by short-term factors, such as daily price movements and potential profit-taking ahead of the holiday season.

“The market is approaching the year-end, and big decisions are not being made at this point in time. So, it’s mostly intraday stuff and perhaps some profit-taking emerging ahead of year-end,” Hansen said.

As investors monitor the unfolding economic data, the outlook for gold and other precious metals remains tied to the broader economic narrative, particularly the trajectory of the U.S. labor market and Federal Reserve policies. With the non-farm payrolls report on Friday likely to shape market expectations, gold prices will remain sensitive to any signals that could shift investor sentiment on interest rates and economic growth.

Conclusion

As the spotlight turns to the upcoming U.S. jobs report, gold prices face pressure due to market uncertainty over the Federal Reserve’s interest rate decisions. The potential for a stronger-than-expected non-farm payrolls report may dampen expectations of a December rate cut, weighing on the precious metal’s prospects in the short term. However, any signs of economic weakness could provide support for gold, which remains a key asset for investors seeking protection from economic volatility. As the year draws to a close, investors are likely to remain on edge, awaiting further clarity on both the U.S. economic outlook and the Fed’s policy stance.

Related topics: