Gold has always been a valuable asset in India, whether for investment or as a symbol of wealth. One of the popular forms of gold investment is through gold biscuits, which are also known as gold bars. These gold biscuits come in various weights and purity levels, and their price is determined by several factors, including the global gold price, local taxes, and demand. In this article, we will explore everything you need to know about the gold biscuit rate in India, how it’s determined, and factors influencing its price.

What Is a Gold Biscuit?

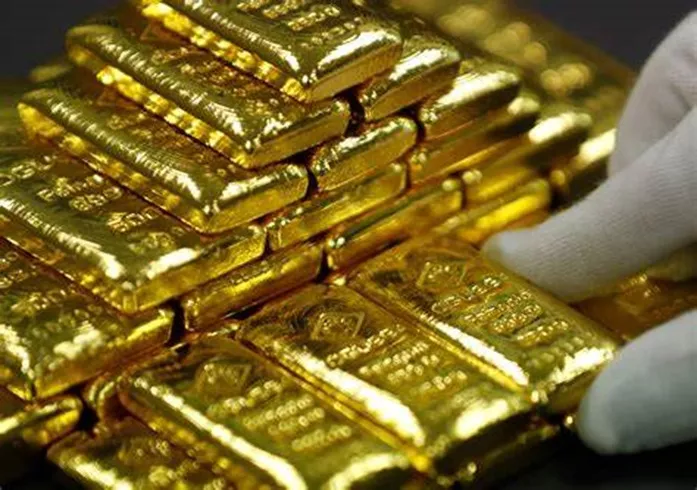

A gold biscuit is a rectangular-shaped piece of gold that is usually sold in various weights, ranging from 1 gram to 1 kilogram. The term “biscuit” is used because of its shape, which resembles a rectangular slab or “biscuit.” These biscuits are typically made of 24-karat gold, which is the purest form of gold.

Gold biscuits are often preferred by investors who wish to purchase gold in bulk for investment purposes. They are considered an excellent store of value and are often seen as a hedge against inflation and economic uncertainty.

How Is the Gold Biscuit Rate in India Determined?

The price of gold biscuits in India is closely linked to the international price of gold, which fluctuates based on global economic conditions, political stability, and the strength of major currencies, especially the US dollar. The following are key factors influencing the gold biscuit rate:

Global Gold Price

Gold is traded on international markets, and the price is quoted in US dollars per ounce. The rate at which gold is traded internationally affects the local market rates in India. Changes in global demand for gold, such as demand from central banks or large investors, can cause fluctuations in the price.

Indian Rupee Exchange Rate

As the price of gold is quoted in US dollars, the value of the Indian Rupee (INR) against the US dollar also plays a role in determining the gold price in India. If the rupee weakens against the dollar, the price of gold tends to rise in India, and vice versa.

Import Duties and Taxes

India is one of the largest consumers of gold in the world. The Indian government imposes import duties on gold to manage the demand for the metal and balance the current account deficit. These duties, along with the Goods and Services Tax (GST) of 3%, affect the final price of gold biscuits in India.

Local Market Conditions

Gold prices also depend on the demand and supply dynamics in the local market. During times of festivals like Diwali, Akshaya Tritiya, or wedding seasons, the demand for gold increases, which can push prices higher.

Gold Biscuit Rate in India: How Much Does It Cost?

As of the latest update, the gold biscuit rate in India varies between ₹5,500 and ₹6,500 per gram. This is based on the international gold price of approximately $1,900 per ounce. However, the rate can vary depending on the city, the weight of the biscuit, and the brand selling it.

For example, a 10-gram gold biscuit can cost anywhere between ₹55,000 to ₹65,000 in India. A 1-kilogram biscuit can cost over ₹60,00,000 (₹60 Lakhs). The price of gold fluctuates daily, and it’s important for investors to monitor the market closely if they wish to buy or sell gold biscuits.

How to Buy Gold Biscuits in India?

Buying gold biscuits in India is a simple process, but it’s important to ensure you are purchasing from a trusted source. You can buy gold biscuits from:

Authorized Dealers and Banks

Many leading banks in India, such as State Bank of India (SBI) and ICICI, offer gold biscuits for sale. You can also purchase from authorized gold dealers and reputed jewelry stores that deal with gold bullion.

Online Platforms

With the rise of e-commerce, buying gold biscuits online has become easier. Platforms like Amazon India, Tanishq, and MMTC-PAMP sell gold biscuits. When buying online, make sure the seller is reputable and provides certifications of authenticity.

Purity of Gold Biscuits: What to Look For?

The purity of the gold biscuit is an important factor to consider when buying. Gold biscuits are typically 24-karat gold, meaning they contain 99.9% pure gold. The purity level is usually stamped on the biscuit itself.

To verify the authenticity and purity of a gold biscuit, check for a Hallmark. The Bureau of Indian Standards (BIS) certifies gold products in India, and the BIS Hallmark guarantees that the gold is of the specified purity.

Factors Affecting the Price of Gold Biscuits in India

Several factors can influence the gold biscuit rate in India:

Inflation and Economic Factors

Gold is often considered a safe-haven asset during times of economic uncertainty. When inflation rises or the economy shows signs of weakness, the demand for gold typically increases, which in turn drives up the price of gold biscuits.

Global Crises and Geopolitical Events

During global crises such as wars, pandemics, or economic instability, gold prices tend to rise as investors seek stable investments. Any such events can cause fluctuations in the gold biscuit rate.

Government Policies

Government policies regarding gold import duties, taxes, and any other measures to control the gold market can have a significant impact on the gold price in India. For example, an increase in import duty on gold may cause the price of gold biscuits to rise.

Investment in Gold Biscuits: Is It a Good Idea?

Investing in gold biscuits is a popular choice among Indian investors. It offers a relatively safe and stable investment option, especially during times of market volatility. Unlike gold jewelry, gold biscuits are sold based on their weight and purity, making them a more straightforward and cost-effective way to invest in gold.

Gold biscuits can be a long-term investment, as the price of gold tends to increase over time, especially in times of inflation. They can also be easily liquidated, as they are recognized internationally and have a universal value.

Conclusion

The gold biscuit rate in India fluctuates based on various factors, including the global gold price, taxes, and demand. It is an attractive investment option due to its purity, ease of storage, and liquidity. Whether you’re an investor looking for a safe-haven asset or someone who loves collecting precious metals, gold biscuits offer a great way to own gold.

As with any investment, it’s essential to stay updated on market trends and consult with a financial advisor to make informed decisions. Be sure to buy from authorized dealers to ensure the authenticity of the product.

Related Topics: