Central banks play a pivotal role in the global financial system, influencing economic stability and currency values. One of the intriguing ways they exercise this influence is through their gold reserves. Central bank gold purchases have the potential to send ripples through the global gold market, affecting prices, investor sentiment, and the broader economy. In this article, we will explore the mechanisms behind central bank gold purchases and their impact on the global gold market.

I. Understanding Central Bank Gold Reserves

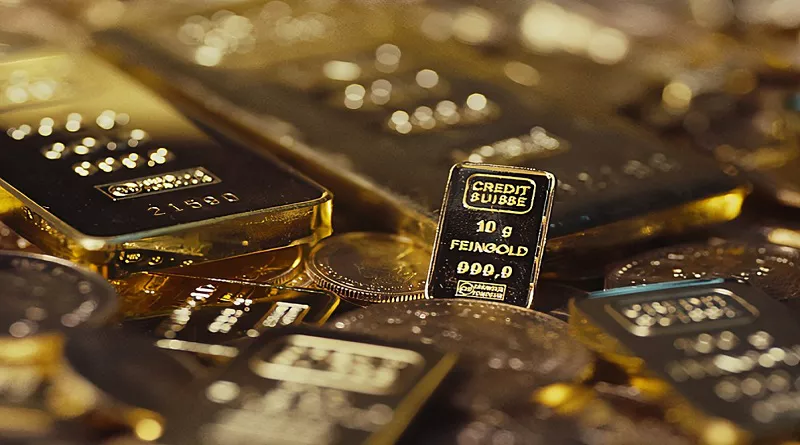

Central banks across the world hold substantial quantities of gold in their reserves. These reserves serve various purposes, including bolstering the stability of their national currencies, acting as a hedge against economic downturns, and ensuring international financial credibility. Historically, gold has been considered a reliable store of value, and central banks have accumulated gold reserves for centuries.

II. The Mechanism of Central Bank Gold Purchases

Central banks acquire gold reserves through various means, including purchases, mining, and international agreements. When central banks decide to increase their gold reserves, they typically do so by purchasing gold in the open market or through bilateral agreements with other countries or institutions. These purchases can be significant, and their timing and volume can have far-reaching consequences.

III. Impact on Gold Prices

One of the most immediate effects of central bank gold purchases is their impact on gold prices. When a central bank enters the market to buy gold, it creates additional demand, which can drive up prices. This price increase can influence the sentiment of other investors, prompting them to buy gold as well. Conversely, if central banks decide to sell gold from their reserves, it can put downward pressure on prices.

IV. Sentiment and Market Confidence

Central bank gold purchases can also impact market sentiment and investor confidence. When central banks increase their gold reserves, it sends a signal to the market that gold is a valuable asset and can enhance investor confidence in the precious metal. This confidence can spill over into other sectors of the economy and affect investment decisions, including those related to other commodities and currencies.

V. Currency Values

Another critical aspect of central bank gold purchases is their influence on currency values. Gold is often seen as a hedge against currency devaluation and economic instability. When central banks increase their gold reserves, it can be interpreted as a lack of confidence in their own currency. This perception can lead to a depreciation of the domestic currency, which can have significant economic implications, including affecting trade balances and inflation rates.

VI. Global Economic Stability

Central bank gold purchases can also impact global economic stability. Gold is a global asset, and changes in its price and availability can have widespread consequences. Large-scale central bank purchases or sales of gold can disrupt global financial markets and create uncertainty, which may spill over into other asset classes and affect economic stability.

FAQs on Central Bank Gold Purchases and the Global Gold Market

Q1: Which central banks are the largest holders of gold reserves?

A1: Historically, the United States, Germany, and the International Monetary Fund (IMF) have been among the largest holders of gold reserves. However, the ranking of central banks with the largest gold reserves can change over time due to various factors, including purchases and sales.

Q2: Can central bank gold purchases be influenced by geopolitical events?

A2: Yes, geopolitical events can influence central bank gold purchases. In times of increased geopolitical uncertainty or economic instability, central banks may choose to increase their gold reserves as a safe haven asset.

Q3: How do central bank gold purchases impact the gold mining industry?

A3: Central bank gold purchases can affect the demand for newly mined gold. When central banks buy gold, they create additional demand, which can provide support to the gold mining industry and influence exploration and production decisions.

Q4: Are central bank gold purchases transparent and publicly disclosed?

A4: Many central banks provide regular updates on their gold holdings as part of their monetary policy and financial reporting. However, the level of transparency can vary from one central bank to another.

Q5: Can central bank gold purchases affect the price of other precious metals like silver and platinum?

A5: Yes, central bank gold purchases can indirectly impact the prices of other precious metals. Increased investor interest in gold due to central bank purchases can spill over into other precious metals, influencing their prices as well.

In conclusion, central bank gold purchases have the potential to significantly impact the global gold market and have far-reaching consequences on gold prices, investor sentiment, currency values, and economic stability. These purchases are closely watched by market participants and can serve as important indicators of central banks’ confidence in the global financial system. As central banks continue to manage their gold reserves, their actions will remain a critical factor in the dynamics of the global gold market.