The gold standard, a monetary system where the value of a country’s currency is directly linked to a specific quantity of gold, has historically played a pivotal role in shaping international trade and finance. Its influence on global economic dynamics, currency stability, and the regulation of international monetary transactions has been significant. Understanding the mechanisms and implications of the gold standard is crucial in comprehending its impact on international trade and finance and its historical significance in the evolution of the global monetary system.

I. Historical Context and Implementation of the Gold Standard

The gold standard gained prominence during the 19th and early 20th centuries, with several major economies adopting it as the foundation of their monetary systems. Under the gold standard, participating countries would set a fixed price for their currency in terms of gold, ensuring that the currency could be readily converted into a specific amount of gold. This fixed exchange rate system provided a sense of monetary stability and predictability, fostering confidence in international trade and financial transactions.

II. Impact on International Trade

Stable Exchange Rates and Trade Facilitation

The gold standard facilitated stable exchange rates between participating countries, providing a conducive environment for international trade. Fixed exchange rates under the gold standard minimized currency fluctuations and mitigated exchange rate risks, encouraging cross-border trade by enhancing price predictability and reducing uncertainties associated with fluctuating currency values. This stability contributed to the expansion of international trade and the development of global economic integration during the gold standard era.

Promotion of Price Transparency and Global Monetary Equilibrium

By anchoring currencies to a fixed gold price, the gold standard promoted price transparency and parity across different economies. This equilibrium in global monetary values facilitated a more streamlined international trade environment, as it enabled businesses and traders to accurately assess the relative values of goods and services across different countries. The transparency offered by the gold standard fostered a level playing field for international trade participants, enhancing market efficiency and promoting fair trade practices.

III. Impact on International Finance

Limitations on Monetary Policy Flexibility

The adoption of the gold standard imposed limitations on the flexibility of participating countries’ monetary policies. Since the supply of gold is inherently limited, countries adhering to the gold standard faced constraints in adjusting their monetary policies to address domestic economic challenges, such as inflation or recession. The inability to implement independent monetary policies constrained governments from effectively managing their economies, potentially leading to prolonged economic downturns and financial instability.

Gold Reserves and Foreign Exchange Stability

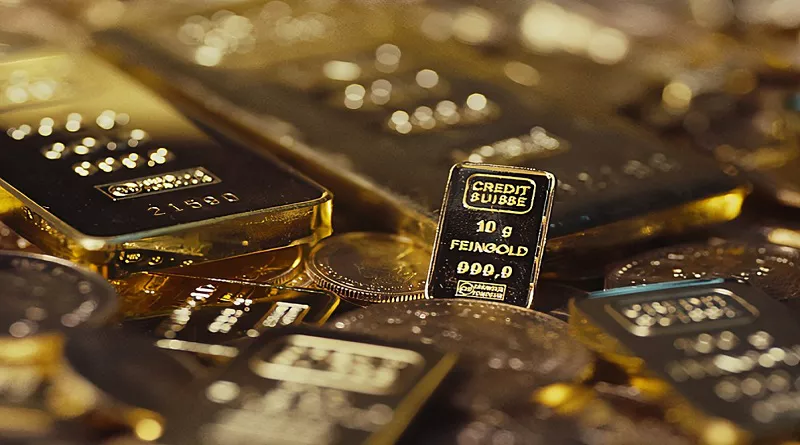

The maintenance of significant gold reserves was a key aspect of the gold standard, serving as a cornerstone for ensuring foreign exchange stability and bolstering investor confidence. Countries with substantial gold reserves enjoyed greater credibility in the international financial community, as these reserves acted as a tangible assurance of their currency’s value and stability. The accumulation of gold reserves played a crucial role in reinforcing the strength of a country’s currency and its ability to participate in global financial transactions with confidence.

IV. Transition Away from the Gold Standard

Challenges and Abandonment

The gold standard faced significant challenges during the early 20th century, particularly during times of economic upheaval such as the Great Depression. The rigidities of the gold standard contributed to deflationary pressures and constrained countries’ abilities to implement effective monetary policies to stimulate economic recovery. These challenges ultimately led to the abandonment of the gold standard by several major economies, as they sought more flexible monetary systems to address the complexities of modern economic challenges and promote sustainable growth.

Legacy and Modern Relevance

While the gold standard is no longer a prominent feature of the modern global monetary system, its legacy continues to influence contemporary discussions surrounding monetary policy and international finance. The historical significance of the gold standard serves as a point of reference for policymakers and economists, providing valuable insights into the complexities of maintaining currency stability, fostering international trade, and managing global financial risks. The principles and lessons derived from the era of the gold standard remain relevant in shaping contemporary monetary frameworks and guiding discussions on the evolution of the international monetary system.

V. FAQs

Q1: Why was the gold standard abandoned by many countries?

The gold standard was abandoned by many countries due to its inherent limitations in addressing economic challenges, particularly during times of economic crises such as the Great Depression. The rigidity of the gold standard constrained countries’ abilities to implement effective monetary policies to stimulate economic growth and stability, leading to the exploration of more flexible monetary systems that could better accommodate the complexities of modern economies.

Q2: How did the Bretton Woods Agreement impact the legacy of the gold standard?

The Bretton Woods Agreement, established in 1944, represented a new phase in the international monetary system, introducing a modified version of the gold standard known as the Bretton Woods system. While it retained some elements of the gold standard, such as fixed exchange rates, it allowed for greater flexibility and introduced the US dollar as the primary reserve currency, marking a significant shift away from the traditional gold-backed monetary system.

Q3: What are some contemporary perspectives on reintroducing the gold standard in modern economics?

Contemporary perspectives on reintroducing the gold standard in modern economics vary, with proponents highlighting its potential to provide a stable monetary foundation and mitigate inflationary risks. However, critics often emphasize the limitations of the gold standard in addressing the complexities of the modern global economy, citing concerns related to limited monetary policy flexibility and the potential constraints on economic growth and stability.

Conclusion

The gold standard’s influence on international trade and finance has left a significant mark on the evolution of the global monetary system. While its historical significance underscores the importance of stable exchange rates and currency predictability in fostering international trade, the challenges and limitations associated with the gold standard led to its eventual transition away from the modern global monetary framework. Understanding the impact of the gold standard on international trade and finance provides valuable insights into the complexities of maintaining currency stability and managing global economic dynamics, serving as a foundational framework for contemporary discussions on monetary policy and the international financial system.