Investors seeking exposure to gold often find themselves contemplating between holding physical spot gold and investing in gold funds. Both options come with distinct advantages and considerations, catering to different investor preferences and objectives. In this article, we will compare spot gold and gold funds, exploring the characteristics, benefits, and potential drawbacks of each to help investors make informed decisions based on their financial goals and risk tolerance.

I. Spot Gold: The Tangible Asset

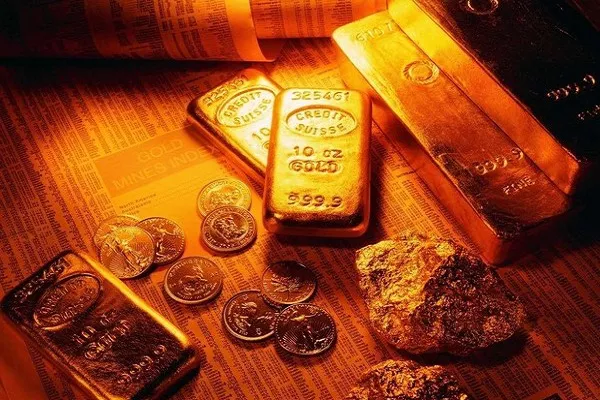

Investing in spot gold involves purchasing physical gold in the form of coins, bars, or jewelry. One of the primary advantages of holding spot gold is the tangible nature of the asset. Investors physically possess the gold they own, providing a sense of security and ownership. Additionally, spot gold is not subject to management fees or the performance of external entities, making it a straightforward and transparent form of gold ownership.

II. Advantages of Spot Gold: Security and No Management Fees

The inherent value and tangibility of spot gold appeal to investors looking for a secure and direct way to own gold. Unlike gold funds, spot gold doesn’t involve intermediary institutions, reducing the counterparty risk associated with financial instruments. Moreover, the absence of management fees enhances the cost-effectiveness of holding spot gold, making it an attractive option for long-term investors seeking a store of value.

III. Considerations with Spot Gold: Storage and Liquidity Challenges

While holding physical gold can offer a sense of security, it comes with practical challenges, notably in terms of storage. Storing large quantities of gold securely can be cumbersome and costly. Furthermore, selling spot gold may not be as swift as selling financial instruments, potentially leading to liquidity challenges, especially during times of market volatility.

IV. Gold Funds: Diversification and Professional Management

Gold funds, including exchange-traded funds (ETFs) and mutual funds, provide investors with exposure to gold without the need to own physical assets. One of the key advantages of gold funds is the ability to diversify across a broad range of gold-related assets. Professional fund managers actively manage these funds, making decisions based on market conditions and trends.

V. Advantages of Gold Funds: Diversification and Liquidity

Gold funds offer investors the opportunity to diversify their portfolios without the need for physical storage. The ease of buying and selling gold funds on the stock market enhances liquidity, providing investors with flexibility in managing their positions. Additionally, gold funds may track specific gold indices, allowing investors to gain exposure to a basket of gold-related assets rather than a single unit of physical gold.

VI. Considerations with Gold Funds: Management Fees and Counterparty Risk

While gold funds provide diversification and liquidity, they come with management fees that can impact overall returns. Investors should carefully assess these fees and consider their impact on the cost-effectiveness of holding gold funds. Additionally, gold funds introduce counterparty risk, as the value of the fund is tied to the performance of the underlying assets and the management decisions made by fund managers.

VII. Spot Gold vs Gold Funds: Choosing the Right Fit

The choice between spot gold and gold funds ultimately depends on individual investor preferences, risk tolerance, and financial goals. Investors seeking the tangibility and security of physical assets may lean towards spot gold, while those prioritizing diversification, liquidity, and professional management may find gold funds more suitable.

VIII. FAQs on Spot Gold vs Gold Funds

Q1: Can I receive dividends from gold funds?

A1: Gold funds typically do not pay dividends. The return on investment is primarily through changes in the value of the fund, reflecting the performance of the underlying gold assets.

Q2: Are there tax implications for holding spot gold?

A2: The tax treatment of spot gold varies depending on the jurisdiction. In some cases, capital gains tax may apply when selling physical gold. It’s advisable to consult with a tax professional to understand the specific tax implications in your location.

Q3: How do gold funds track the price of gold?

A3: Gold funds may track the price of gold through various methods, such as physically holding gold, using futures contracts, or investing in gold-related equities. The specific tracking method varies among different funds.

Q4: Can I redeem my spot gold for cash easily?

A4: Selling spot gold for cash can be done through various channels, such as local dealers, pawn shops, or online platforms. However, the ease of redemption may depend on market conditions and the form of gold you own.

Q5: What factors should I consider when deciding between spot gold and gold funds?

A5: Consider your preference for tangible assets, storage capabilities, liquidity needs, and the desire for professional management. Assess the impact of management fees and the level of risk you are comfortable with in your investment strategy.

In conclusion, both spot gold and gold funds offer unique advantages and considerations. Investors should carefully evaluate their financial objectives and preferences before choosing the option that aligns with their goals and risk tolerance. The FAQs provide additional insights to assist investors in making informed decisions based on their individual circumstances.