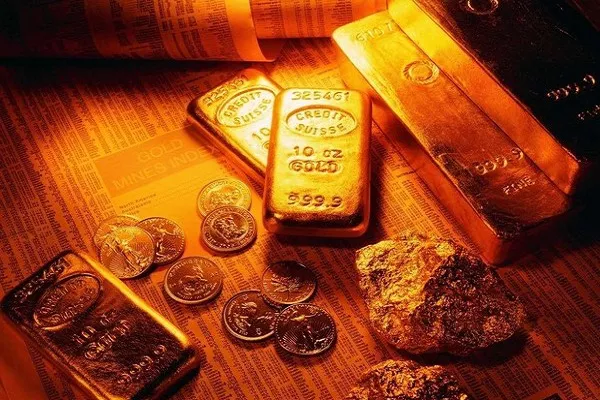

The allure of gold has persisted throughout human history, captivating civilizations, traders, and investors alike. As a precious metal with intrinsic value, gold has been a symbol of wealth, a medium of exchange, and a store of value. The question arises: should everyone strive to acquire as much gold knowledge as they possibly can? In this exploration, we will delve into the various aspects of gold, its significance, and the considerations individuals might contemplate when seeking to deepen their understanding of this precious metal.

The Historical Significance of Gold Knowledge

Understanding the historical significance of gold is a compelling reason for individuals to seek knowledge about this precious metal. Gold has been used as currency, jewelry, and a symbol of status for centuries. Familiarity with the historical contexts in which gold played a pivotal role provides insight into the evolution of economies, trade, and societal values. It also offers a lens through which individuals can appreciate the enduring appeal of gold across diverse cultures and time periods.

Gold as a Financial Asset

One of the primary motivations for acquiring gold knowledge is its status as a financial asset. Gold serves as a hedge against inflation, economic uncertainty, and currency fluctuations. Investors often turn to gold as a safe haven, especially during times of economic turbulence. Understanding how gold behaves within the broader financial landscape equips individuals with the knowledge to make informed investment decisions, whether they choose to hold physical gold, invest in gold-backed instruments, or engage in gold futures trading.

Diversification Strategies and Risk Management

Gold’s role in portfolio diversification is a key aspect that individuals should consider when aiming to enhance their knowledge. Gold tends to have a low correlation with other financial assets, such as stocks and bonds. This low correlation can be advantageous for investors seeking to spread risk and reduce the overall volatility of their portfolios. Knowledge about effective diversification strategies involving gold can contribute to more resilient and balanced investment portfolios.

Mining and Production Processes

Acquiring knowledge about the mining and production processes of gold provides insights into the practical aspects of the gold industry. From extraction to refining, understanding how gold is sourced and processed contributes to a comprehensive grasp of the metal’s journey from the earth to the market. Knowledge in this domain is valuable not only for investors but also for those interested in the environmental and social implications associated with gold mining.

Risks and Considerations in Gold Investment

While gold is often seen as a stable and secure investment, it is not without risks. Fluctuations in gold prices, geopolitical factors, and changes in market dynamics can impact the performance of gold investments. Individuals striving to acquire gold knowledge should familiarize themselves with the risks associated with different forms of gold investment, enabling them to make informed decisions aligned with their risk tolerance and financial goals.

The Role of Gold in Modern Finance

In the contemporary financial landscape, gold continues to play a role beyond being a traditional safe haven. Understanding the evolving dynamics of gold in modern finance involves exploring its use in financial instruments, such as exchange-traded funds (ETFs), and its integration into innovative financial technologies. Individuals with a keen interest in finance and investment trends can benefit from staying abreast of how gold intersects with the latest developments in the financial world.

FAQs on Gold Knowledge

Q1: Can I invest in gold without buying physical gold?

A1: Yes, individuals can invest in gold through various means, including gold-backed ETFs, gold mining stocks, and futures contracts. These instruments allow investors to gain exposure to the price movements of gold without owning physical metal.

Q2: Is gold a good investment for everyone?

A2: While gold can be a valuable addition to investment portfolios, whether it is a good investment for everyone depends on individual financial goals, risk tolerance, and investment preferences. It’s advisable to carefully consider personal circumstances before making investment decisions.

Q3: How is the price of gold determined?

A3: The price of gold is influenced by supply and demand dynamics in the global market. Factors such as economic conditions, interest rates, and geopolitical events can also impact gold prices.

Q4: Are there environmental concerns associated with gold mining?

A4: Yes, gold mining can have environmental impacts, including habitat disruption, water pollution, and the use of toxic chemicals. Responsible and sustainable mining practices aim to mitigate these concerns.

Q5: Can I use gold as a long-term investment?

A5: Yes, gold is often considered a suitable long-term investment, especially as a hedge against inflation and economic uncertainties. Many investors view gold as a store of value over extended periods.

In conclusion, the acquisition of gold knowledge is a multifaceted endeavor that encompasses historical, financial, and practical aspects. Whether driven by an interest in history, a desire for financial security, or a curiosity about the intricacies of the gold industry, individuals stand to gain valuable insights by delving into the world of gold. The FAQs offer additional guidance on common queries related to gold knowledge, providing a comprehensive resource for those embarking on this educational journey.