The investment landscape has witnessed the rise of various asset classes, with spot gold and cryptocurrencies emerging as prominent players. While spot gold has a centuries-old legacy as a store of value, cryptocurrencies, led by the likes of Bitcoin and Ethereum, represent a digital frontier with decentralized features. Investors often ponder the compatibility of these seemingly disparate assets. In this comprehensive exploration, we delve into the dynamics of spot gold and cryptocurrencies, examining their characteristics, potential synergies, and the considerations investors should bear in mind when navigating this intriguing intersection.

1. Spot Gold: A Timeless Haven of Value

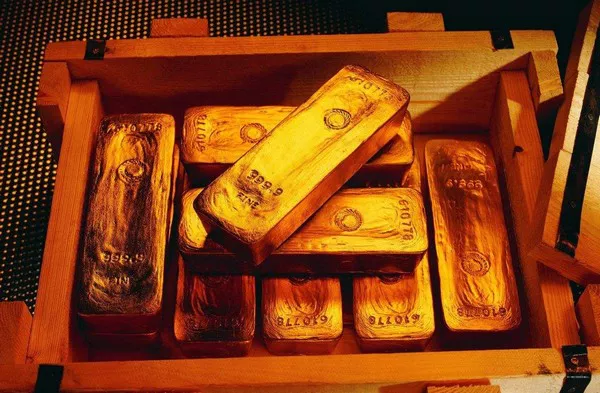

Historical Significance: Spot gold, with its enduring allure, has served as a store of value for centuries. Investors turn to gold during times of economic uncertainty as a hedge against inflation and currency devaluation.

Physical Tangibility: One of the defining features of spot gold is its physical tangibility. Investors can possess gold in various forms, including coins, bars, or jewelry, enjoying the tactile connection to this precious metal.

2. Cryptocurrencies: Digital Pioneers Redefining Finance

Decentralization: Cryptocurrencies operate on decentralized blockchain technology, eliminating the need for intermediaries like banks. This decentralized nature appeals to those seeking financial autonomy.

Digital Nature: Unlike spot gold, cryptocurrencies are entirely digital, existing as lines of code on blockchain networks. This digital nature provides ease of transfer and accessibility to a global audience.

3. Potential Synergies: Exploring Overlapping Traits

Store of Value Argument: Both spot gold and cryptocurrencies have been positioned as stores of value. Advocates argue that gold’s historical track record and the limited supply of major cryptocurrencies contribute to their potential value preservation.

Risk Hedging: Investors often turn to both assets as a hedge against economic volatility. While gold has a long-established reputation in this regard, some see cryptocurrencies as a modern alternative for diversification.

4. Considerations for Investors: Weighing the Pros and Cons

Volatility Dynamics: Cryptocurrencies, notably Bitcoin, are renowned for their price volatility. Investors should be prepared for significant price swings in the crypto market, contrasting with the more stable nature of spot gold.

Market Maturity: Spot gold benefits from a mature and established market with a robust history. Cryptocurrencies, on the other hand, are relatively young, and their market dynamics are still evolving, which may introduce additional risk factors.

5. Diversification Strategies: Balancing Portfolios

Diversifying Across Assets: Investors exploring the compatibility of spot gold and cryptocurrencies often consider incorporating both into their portfolios. Diversification across traditional and digital assets can offer a balanced risk-reward profile.

Allocation Ratios: The allocation ratio between spot gold and cryptocurrencies depends on individual risk tolerance, investment goals, and the desired level of exposure to each asset class.

FAQs on Spot Gold and Cryptocurrencies Compatibility

Q1: Can I buy spot gold using cryptocurrencies?

A1: While the direct purchase of spot gold with cryptocurrencies may not be universally accepted, some platforms and dealers facilitate the exchange of cryptocurrencies for gold-backed tokens or certificates. Investors should research and choose platforms that align with their preferences.

Q2: What role does market sentiment play in the compatibility of spot gold and cryptocurrencies?

A2: Market sentiment can significantly impact both spot gold and cryptocurrency prices. Investors should stay informed about global economic conditions, geopolitical events, and market trends to make informed decisions about their asset allocations.

Q3: Are there gold-backed cryptocurrencies, and how do they differ from spot gold?

A3: Yes, there are gold-backed cryptocurrencies that aim to represent ownership of physical gold. However, they differ from spot gold as they are digital tokens on blockchain networks, providing a different form of exposure to gold’s value.

Q4: How does regulatory scrutiny affect the compatibility of cryptocurrencies with spot gold?

A4: Regulatory scrutiny varies across jurisdictions and can impact the compatibility of cryptocurrencies with spot gold. Investors should stay informed about regulatory developments in the regions where they operate to ensure compliance with legal requirements.

Q5: What are the tax implications of holding spot gold and cryptocurrencies in a portfolio?

A5: Tax implications depend on jurisdiction and can vary for spot gold and cryptocurrencies. Investors should consult with tax professionals to understand the tax implications of holding both assets and ensure compliance with relevant tax laws.

In conclusion, the compatibility of spot gold and cryptocurrencies lies at the crossroads of tradition and innovation. While both assets share certain characteristics as stores of value, they also exhibit distinct features that cater to different investor preferences. As investors navigate this intersection, it is essential to carefully consider factors such as volatility, market maturity, and individual risk tolerance. By weighing the pros and cons and adopting diversified strategies, investors can harness the potential synergies of spot gold and cryptocurrencies, forging a balanced and resilient investment portfolio.