Investing in spot gold can be a lucrative and strategic move for investors looking to diversify their portfolios and hedge against economic uncertainties. Spot gold, often considered a safe-haven asset, allows investors to directly own physical gold, providing a tangible and historically reliable store of value. In this comprehensive guide, we will walk you through the steps of buying spot gold, from understanding the basics to making informed investment decisions.

1. Understanding Spot Gold

Before delving into the process of buying spot gold, it’s crucial to grasp what “spot” means in the context of precious metals. Spot gold refers to the current market price for immediate delivery and payment. Unlike futures contracts, spot transactions involve the physical exchange of gold at the prevailing market rate.

Gold is universally recognized for its intrinsic value and has been used as a form of currency for centuries. Its appeal lies in its ability to retain value over time, acting as a hedge against inflation and economic downturns.

2. Assessing Your Investment Goals and Risk Tolerance

Before purchasing spot gold, it’s essential to assess your investment goals and risk tolerance. Are you looking for a long-term store of value, or do you aim to capitalize on short-term market fluctuations? Understanding your objectives will help determine the amount of gold to buy and the investment strategy to adopt.

Additionally, consider your risk tolerance. While gold is generally considered a lower-risk asset, market conditions can still impact its value. Be prepared for fluctuations and have a clear understanding of how much risk you are comfortable taking on.

3. Choosing a Reputable Dealer

Selecting a reputable gold dealer is a critical step in the buying process. Look for dealers with a proven track record, transparent pricing, and secure storage options. Verify that the dealer is accredited by relevant industry bodies and has positive reviews from other investors.

Research the dealer’s policies regarding shipping, storage fees, and buyback options. A trustworthy dealer will provide clear information on these aspects and have excellent customer service to address any concerns.

4. Determining the Form of Gold to Purchase

Spot gold can be bought in various forms, each with its own advantages and considerations. Common options include:

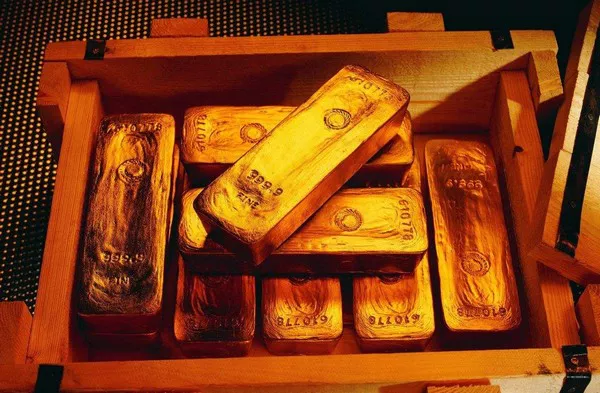

Physical Gold Bars and Coins: Investors looking to possess physical gold often opt for bars or coins. Bars are available in various weights, while coins may have numismatic value in addition to their gold content.

Gold ETFs (Exchange-Traded Funds): For those seeking exposure to gold without holding physical assets, gold ETFs are a popular choice. These funds track the price of gold and are traded on stock exchanges.

Gold Certificates: Investors can purchase certificates representing ownership of gold without physically holding the metal. However, this option carries counterparty risk, as it relies on the issuer’s financial stability.

5. Understanding Pricing and Premiums

Spot gold prices are influenced by global market conditions and are quoted in troy ounces. It’s essential to understand the concept of premiums, which represent the additional cost above the spot price. Premiums cover manufacturing, distribution, and dealer fees for physical gold products.

Compare premiums across different dealers and forms of gold to ensure you are getting fair pricing. Avoid deals that seem too good to be true, as they may involve hidden costs or compromised quality.

6. Storage Considerations

Deciding where to store your spot gold is a crucial aspect of the buying process. Options include:

Home Storage: Some investors prefer holding physical gold at home. However, this comes with security concerns and potential insurance costs.

Bank Safe Deposit Box: Renting a safe deposit box at a bank provides a secure off-site storage option. Ensure the bank allows storage of precious metals and consider accessibility factors.

Third-Party Storage Services: Professional storage services offer secure vaults with insurance coverage. While convenient, these services may involve additional fees.

7. Securing Your Investment

Once you have acquired spot gold, take steps to secure your investment. Keep purchase records, store physical gold in a secure location, and consider insuring valuable holdings. Regularly review your investment portfolio and adjust your strategy based on changing market conditions and personal financial goals.

8. Staying Informed about Market Trends

To make informed investment decisions, stay informed about market trends and factors influencing gold prices. Economic indicators, geopolitical events, and central bank policies can impact the value of gold. Utilize reliable news sources, financial publications, and market analysis to stay abreast of developments.

9. Consideration of Taxes and Regulations

Before buying spot gold, familiarize yourself with tax implications and regulations related to precious metals in your jurisdiction. Taxes on capital gains and reporting requirements may vary, and compliance is essential to avoid legal issues.

Consult with a tax professional or financial advisor to understand the specific tax implications of your gold investments and ensure proper adherence to regulations.

10. Selling Your Spot Gold

When the time comes to sell your spot gold, be strategic in your approach. Consider market conditions, your financial goals, and any potential tax implications. Revisit the reputable dealers and assess their buyback policies and rates to maximize returns on your investment.

Conclusion

Investing in spot gold requires careful consideration of various factors, from understanding market dynamics to choosing the right form of gold and storage options. By following the steps outlined in this guide, investors can navigate the process with confidence, making informed decisions that align with their financial goals.

Remember that gold is a long-term investment, and its value may fluctuate in the short term. Stay informed, remain patient, and leverage the stability and wealth preservation attributes that spot gold offers in the broader context of your investment portfolio.

Related Topics:

Gold Price Pauses Ahead of US CPI Data, Traders Brace for Market Impact

Gold Prices Await FOMC Verdict Amidst Geopolitical Tensions and Economic Indicators

Gold Bullion: Varieties and Forms of Precious Metal Investment