Gold has long been synonymous with wealth and prosperity, captivating the imaginations of individuals and nations alike. The allure of its lustrous beauty and enduring value has stood the test of time. In this article, we delve into the intriguing question: How much is 1000 tons of gold worth? Brace yourself for a journey through the intricate world of gold valuation.

Understanding the Market Dynamics: Factors Influencing Gold Prices

Supply and Demand Dynamics:

Gold, like any other commodity, is subject to the fundamental principles of supply and demand. As the demand for gold rises, its value tends to follow suit.

Factors such as geopolitical tensions, economic instability, and inflation can trigger an increase in demand for gold as a safe-haven asset.

Mining Costs and Production:

The cost of mining and extracting gold plays a pivotal role in determining its market value. Fluctuations in mining costs can impact the overall supply of gold, consequently affecting its price.

The geographical location of gold mines, extraction technologies, and labor costs are crucial considerations in assessing mining expenses.

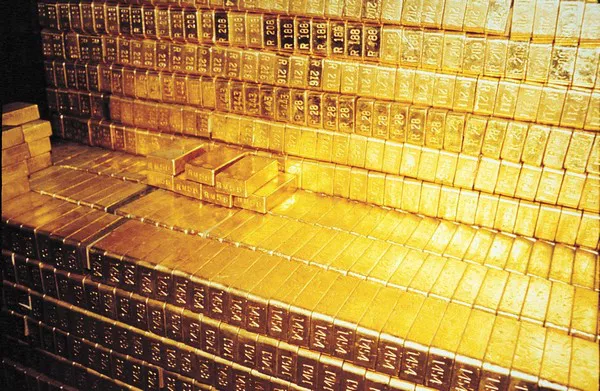

Crunching the Numbers: Calculating the Value of 1000 Tons of Gold

Current Market Price:

To determine the worth of 1000 tons of gold, we first need to establish the current market price per ounce. As of the latest available data, the price per ounce stands at $1,800.

Calculate the value of one ton of gold: $1,800/ounce * 32,000 ounces/ton = $57,600,000 per ton.

Multiply the value per ton by 1000 tons to find the total value: $57,600,000/ton * 1000 tons = $57.6 billion.

Global Gold Reserves:

Understanding the context of 1000 tons of gold requires comparing it to global gold reserves. According to the World Gold Council, the total global gold reserves were approximately 35,000 tons.

Analyzing this against the backdrop of 1000 tons emphasizes the considerable magnitude of such a quantity in the broader context of global gold holdings.

Historical Perspectives: Gold’s Journey Through Time

Gold as a Historical Store of Value:

Throughout history, gold has been a symbol of wealth and a store of value. Its worth has transcended cultures and civilizations, making it an enduring asset class.

Examining historical trends in gold prices and the events that influenced them provides valuable insights into the metal’s resilience.

Gold’s Role in Economic Stability:

During economic downturns and financial crises, gold has often played a crucial role in preserving wealth. Investors flock to gold as a hedge against inflation and currency devaluation.

The historical correlation between gold prices and economic uncertainties highlights the metal’s significance in maintaining stability.

The Impact of Economic Indicators: Macro-Economic Factors and Gold Prices

Interest Rates and Inflation:

In a low-interest-rate environment, gold becomes an attractive investment option as it doesn’t yield interest like bonds. Conversely, rising interest rates can lead to a decrease in gold prices.

Inflation erodes the purchasing power of fiat currencies, making gold a preferred choice for investors seeking to preserve wealth during inflationary periods.

Currency Strength and Weakness:

The strength or weakness of major currencies, especially the U.S. dollar, can significantly influence gold prices. A weaker currency often leads to higher gold prices as it takes more currency units to purchase the same amount of gold.

Global Trends in Gold Consumption: Industrial and Ornamental Uses

Industrial Applications:

Gold’s utility extends beyond its role as a financial asset. It is a crucial component in various industrial applications, including electronics, dentistry, and aerospace.

The demand for gold in technological advancements can impact its overall market dynamics.

Ornamental Demand:

The jewelry industry is a major consumer of gold, with cultural and societal preferences influencing trends in ornamental demand.

Understanding shifts in consumer behavior and preferences provides insights into the future trajectory of gold prices.

Risks and Challenges: Potential Threats to Gold Valuation

Regulatory Changes:

Changes in regulations governing the gold market, such as restrictions on mining operations or the imposition of tariffs, can have profound effects on gold prices.

Investors and industry stakeholders closely monitor regulatory developments to anticipate potential shifts in the market.

Technological Advances:

Advances in mining technologies or the discovery of alternative materials with similar properties to gold could impact its market value.

The intersection of technology and traditional industries poses both challenges and opportunities for the gold market.

Investor Sentiment and Speculation: Riding the Waves of Market Psychology

Speculative Trading:

Gold prices are not solely determined by fundamental factors; market sentiment and speculative trading play a significant role.

Investor perceptions of global events and economic conditions can lead to rapid fluctuations in gold prices based on speculation.

Long-Term Investment Strategies:

Despite short-term market volatility, many investors view gold as a long-term store of value. Diversification strategies often include an allocation to gold to mitigate overall portfolio risk.

Analyzing the historical performance of gold as an investment highlights its role in preserving capital over extended periods.

Conclusion: Deciphering the Value of Gold

In conclusion, the worth of 1000 tons of gold is a complex and multifaceted calculation, intricately woven into the fabric of global economic dynamics. From historical perspectives to contemporary market forces, gold’s value is subject to a myriad of influences. As investors, economists, and enthusiasts continue to monitor the ever-evolving landscape of the gold market, one thing remains certain – the weight of gold transcends its physical mass, carrying with it the weight of centuries of human history and economic evolution.