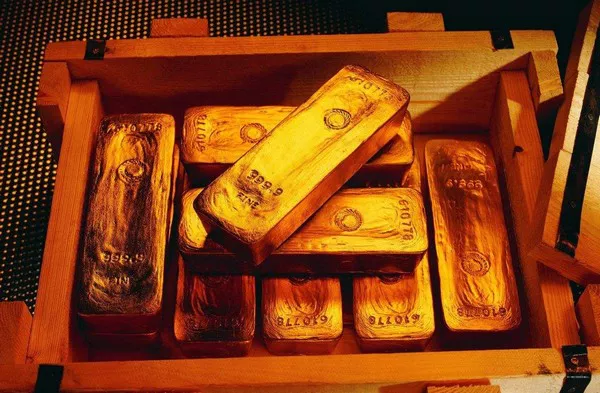

In recent years, a notable trend has emerged in the financial landscape – central banks around the world are increasingly bolstering their gold reserves. This phenomenon raises intriguing questions about the motivations behind such acquisitions. In this comprehensive exploration, we delve into the reasons why central banks are avidly buying substantial amounts of gold.

Understanding Central Banks’ Role: Guardians of Monetary Stability

Before delving into the motivations behind central banks’ gold acquisitions, it’s crucial to grasp the fundamental role these institutions play in the global economy.

1. Historical Significance: Gold as a Monetary Anchor

Gold Standard Legacy:

Historically, gold has been at the core of monetary systems, particularly during the gold standard era. Central banks held gold reserves to provide credibility to their currencies, ensuring a fixed exchange rate with gold.

Stability and Confidence:

Gold’s stability and limited supply instill confidence in central banks. Even though the gold standard is no longer the norm, the legacy of gold as a reliable store of value persists.

2. Hedging Against Economic Uncertainty: A Prudent Strategy

Diversification in Reserves:

Central banks are diversifying their reserves as a risk management strategy. Holding gold alongside traditional assets provides a hedge against economic uncertainties, market volatility, and currency fluctuations.

Resilience in Times of Crisis:

Gold has demonstrated resilience during financial crises. Central banks, keen on protecting their countries’ economic stability, turn to gold as a safe-haven asset that retains its value when other assets may be faltering.

3. Economic Sovereignty: Reducing Dependency on Foreign Currencies

Independence in Monetary Policy:

Central banks aim for economic sovereignty by reducing their reliance on foreign currencies. Accumulating gold reserves allows them to diversify away from holding large amounts of foreign currencies, providing greater control over monetary policy.

Mitigating Currency Risks:

Owning gold helps central banks mitigate risks associated with holding excessive amounts of a single currency. This diversification minimizes the impact of currency devaluation and external economic pressures.

4. Preservation of Wealth: Long-Term Financial Security

Store of Value:

Gold’s reputation as a store of value is a driving force behind central banks’ acquisitions. In uncertain economic climates, the preservation of wealth becomes paramount, and gold offers a reliable means of achieving this goal.

Generational Wealth Transfer:

Gold’s enduring value makes it an attractive option for central banks looking to preserve wealth across generations. The stability of gold ensures its utility as a lasting financial asset.

5. Strategic Geo-Political Considerations: A Game of Financial Chess

International Financial Influence:

The accumulation of gold by central banks can be viewed as a strategic move in the global geopolitical landscape. A robust gold reserve enhances a country’s financial standing and negotiating power on the international stage.

Diversification Amid Global Tensions:

Central banks may increase gold holdings in response to geopolitical tensions. The uncertainty created by international conflicts prompts central banks to bolster their gold reserves, a tangible asset that holds its value irrespective of geopolitical shifts.

6. Risk Management Amidst Monetary Policy Challenges

Low or Negative Interest Rates:

In an environment of low or negative interest rates, central banks face challenges in managing monetary policy effectively. Gold serves as a valuable asset in such scenarios, providing an alternative store of value.

Balancing Inflation and Deflation Risks:

Central banks strategically use gold to balance the risks associated with inflation and deflation. Gold’s intrinsic value makes it a valuable tool in navigating the complex terrain of monetary policy.

7. Changing Dynamics of the Global Economy: Adapting to New Realities

Shift in Economic Power:

The rise of emerging economies and the shifting dynamics of global economic power influence central banks’ gold-buying strategies. As these nations ascend in economic prominence, accumulating gold enhances their financial resilience.

Potential De-Dollarization:

The accumulation of gold can be seen as a move towards reducing dependency on the U.S. dollar. As the global economy evolves, central banks explore ways to diversify their reserves and lessen exposure to the dollar’s dominance.

Conclusion: The Golden Chessboard of Central Banking

In conclusion, the surge in central banks’ gold acquisitions is a multi-faceted phenomenon rooted in historical legacies, prudent risk management, and strategic positioning in the global economic chessboard. As guardians of monetary stability, central banks navigate the intricate dynamics of the financial landscape, employing gold as a key player in their arsenal.

The allure of gold, with its timeless stability and enduring value, aligns with central banks’ objectives of preserving wealth, mitigating risks, and adapting to the evolving contours of the global economy. While the world of central banking continues to evolve, gold remains a shining symbol of financial prudence and strategic foresight for those entrusted with steering the economic destinies of nations.