Gold Road Resources Ltd (ASX: GOR), a prominent constituent of the S&P/ASX 200 Index (ASX: XJO) in the gold sector, finds itself trailing behind competitors in recent market performance.

Despite a notable surge in the price of gold, Gold Road’s shares have only seen a modest uptick of 4.5% over the past month. This pales in comparison to the substantial 12.6% increase recorded by the S&P/ASX All Ordinaries Gold Index (ASX: XGD) during the same period.

Today, both Gold Road shares and the All Ordinaries Gold Index are experiencing declines.

Production Decline Hits ASX 200 Gold Share

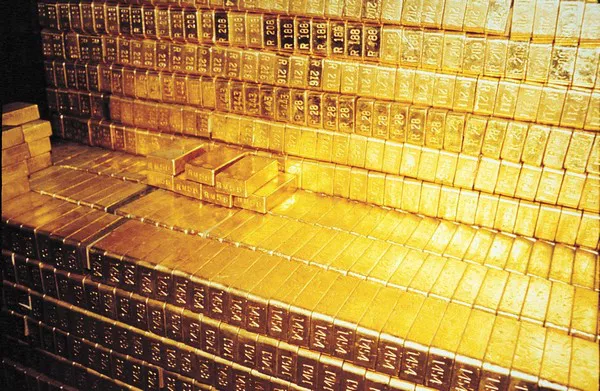

Gold Road’s primary production originates from the Gruyere Gold Mine in Western Australia, operated through a 50:50 joint venture with Gruyere Mining Company.

The ASX 200 gold share reported a decrease in quarterly gold production, with Gruyere delivering 64,323 ounces (on a 100% basis) over the last quarter. This figure marks a notable 14% decline from the 74,659 ounces produced in the preceding quarter, primarily attributed to adverse weather conditions impacting production in March.

Moreover, production costs witnessed an upward trend. The miner’s All-in-Sustaining Cost (AISC) rose to $2,194 per attributable ounce, reflecting an 11% increase from $1,973 per ounce in the previous quarter.

In terms of sales, the ASX 200 gold share sold 32,325 ounces of gold at an average price of $3,137 per ounce, generating sales revenue of $101.4 million. This signifies a decline from the 37,037 ounces of gold sold in the December quarter, albeit with a marginal increase in the average selling price compared to the previous quarter.

Management underscored that the gold sales for the quarter did not encompass 1,825 ounces of gold doré and bullion held in inventory as of 31 March.

For the quarter, Gold Road’s attributable operating cash flow from Gruyere amounted to $57.9 million, while capital expenditure stood at $27.0 million.

However, free cash flow dwindled to $5.5 million for the quarter, down from $13.8 million in the preceding quarter.

As of 31 March, Gold Road maintained cash and equivalents totaling $146 million, with no outstanding debt.