Gold prices have softened, marking a one-week low, as concerns surrounding potential conflicts in the Middle East subside. Investors, buoyed by diminished worries over an escalation in the region, are exhibiting a heightened appetite for risk, consequently diminishing the demand for gold as a safe-haven asset.

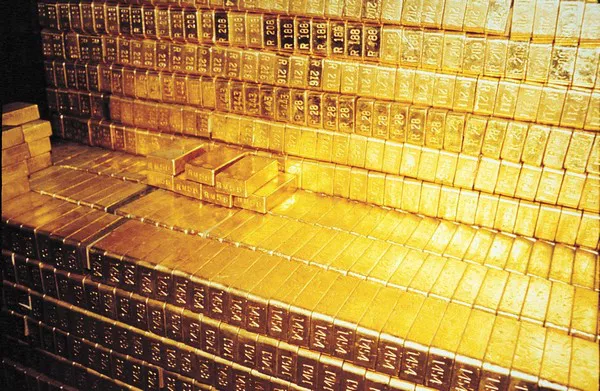

At present, spot gold is down by 0.85%, settling at $2,333.29 per ounce, while American gold futures remain stable at $2,346.70 per ounce.

In an apparent effort to mitigate regional tensions, Tehran has downplayed Israel’s retaliatory drone strike against Iran.

Last week, notable figures such as US Federal Reserve Chair Jerome Powell refrained from offering specific forecasts regarding the timing of potential interest rate cuts. Instead, they emphasized the necessity of maintaining a tight monetary policy for an extended period.

The allure of non-yielding gold diminishes with the ascent of interest rates.

Market participants are eagerly anticipating the release of March’s personal consumption expenditure (PCE) data later this week, a key inflation metric favored by the Federal Reserve, to glean insights into the trajectory of monetary policy.

Despite mounting inflationary pressures in the United States delaying the Fed’s pivot towards a more accommodative stance, members of the European Central Bank remain committed to multiple interest rate cuts throughout the year.

Nornickel, the world’s largest producer of palladium and high-grade nickel, disclosed a 3% increase in palladium output to 745 koz in the first quarter, with projections aiming for 2,296-2,451 koz in 2024.

With a resurgence in tech shares, subdued activity in fixed-income markets, and a relaxation of geopolitical tensions, Asian stocks are poised for optimism on Tuesday.

Elsewhere in the precious metals market, spot silver edged up by 0.4% to $27.31 per ounce, while palladium dipped marginally by 0.1% to $1,007.58 and platinum experienced a modest uptick of 0.2% to $919.05.