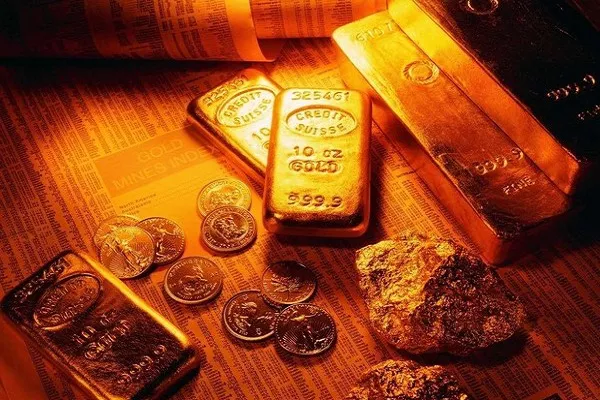

In the realm of investment, gold stands as an enduring symbol of wealth and stability. Over the years, various instruments have emerged to allow investors to gain exposure to this precious metal, with Gold Exchange-Traded Funds (ETFs) being one of the most popular choices. While Gold ETFs offer several advantages, such as liquidity and diversification, it’s crucial for investors to be aware of the potential drawbacks associated with these financial products. In this article, we delve into the disadvantages of Gold ETFs, providing investors with a comprehensive understanding of the risks involved in allocating their capital to this asset class.

1. Counterparty Risk

One of the primary disadvantages of Gold ETFs is the presence of counterparty risk. Unlike physical gold ownership, where investors directly possess the metal, Gold ETFs involve the ownership of shares in a fund that holds gold bullion. Consequently, investors are exposed to the credit risk of the ETF issuer. In the event of the issuer’s insolvency or bankruptcy, investors may face challenges in recovering their investment, leading to potential losses.

2. Management Fees

Investing in Gold ETFs entails management fees, which can erode returns over time. These fees are charged by the ETF issuer for managing the fund and can vary significantly among different products. While some Gold ETFs may have relatively low expense ratios, others may impose higher fees, impacting the overall profitability of the investment. Additionally, investors should consider other costs, such as brokerage fees and operational expenses, which can further diminish returns.

3. Price Volatility

Gold prices are notoriously volatile, and this volatility is reflected in the performance of Gold ETFs. While gold is often perceived as a safe-haven asset, its price movements can be influenced by various factors, including geopolitical tensions, economic indicators, and market sentiment. Consequently, investors in Gold ETFs may experience significant fluctuations in the value of their investment, which can lead to both opportunities and risks.

4. Tracking Error

Despite their objective of tracking the price of gold, Gold ETFs may exhibit tracking errors due to factors such as management fees, trading costs, and operational inefficiencies. These deviations from the underlying asset’s performance can impact the returns realized by investors, potentially leading to discrepancies between the ETF’s net asset value (NAV) and the market price of its shares. Investors should closely monitor the tracking error of Gold ETFs to assess their effectiveness in mirroring the performance of the underlying gold bullion.

5. Liquidity Constraints

While Gold ETFs are generally considered to be highly liquid instruments, there may be instances where liquidity constraints arise, particularly during periods of market stress or disruption. In such circumstances, investors may encounter challenges in buying or selling shares of the ETF at favorable prices, leading to wider bid-ask spreads and increased trading costs. Moreover, illiquidity in the underlying gold market can further exacerbate these issues, potentially impacting the ETF’s ability to meet redemption requests.

6. Tax Implications

Investing in Gold ETFs can have tax implications for investors, depending on their jurisdiction and the specific characteristics of the ETF structure. Capital gains realized from the sale of Gold ETF shares may be subject to taxation at different rates, depending on whether the investment is held for the short term or long term. Additionally, investors should be mindful of any tax reporting requirements associated with holding Gold ETFs, as failure to comply with regulatory obligations could result in penalties or fines.

7. Limited Control Over Holdings

Unlike owning physical gold, investing in Gold ETFs deprives investors of direct control over the underlying assets. While ETF shareholders have a claim to the fund’s gold reserves, they do not have the ability to access or possess the physical metal. This lack of control can be a disadvantage for investors who prefer to have tangible assets in their portfolio or who wish to have greater autonomy over their investment decisions.

Conclusion

While Gold ETFs offer investors a convenient and cost-effective means of gaining exposure to the precious metal, it’s essential to weigh the potential disadvantages associated with these financial products. From counterparty risk and management fees to price volatility and liquidity constraints, there are various factors that investors should consider before allocating capital to Gold ETFs. By conducting thorough due diligence and assessing their investment objectives and risk tolerance, investors can make informed decisions regarding the inclusion of Gold ETFs in their portfolios. Ultimately, understanding the risks and rewards of Gold ETFs is crucial for navigating the complexities of the precious metals market and optimizing investment outcomes.