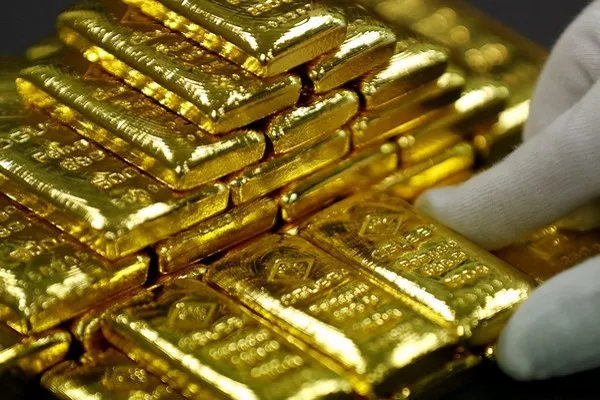

Gold prices saw a slight increase on Tuesday as market participants awaited critical insights from the Federal Reserve regarding its monetary policy stance and awaited a flurry of upcoming U.S. economic data releases.

At 0911 GMT, spot gold showed a modest gain of 0.2%, reaching $2,387.89 per ounce. Similarly, U.S. gold futures rose 0.3% to $2,384.80.

The Federal Reserve is widely expected to maintain current interest rates following its two-day meeting, concluding on Wednesday. However, analysts anticipate signals for potential interest rate cuts starting as early as September, citing inflation nearing the Fed’s target of 2%.

Investor attention is also focused on a series of U.S. employment reports scheduled for release this week, notably the non-farm payrolls report due on Friday.

Giovanni Staunovo, an analyst at UBS, highlighted the significance of these developments, stating, “Payrolls data is expected to indicate a slowdown in job additions. Any indication from Fed officials suggesting an imminent rate cut could further bolster investment demand for gold.”

Market participants will closely monitor remarks from Fed Chair Jerome Powell during Wednesday’s press conference for clues on the timing of potential rate cuts.

The allure of gold is strengthened by lower interest rates, which diminish the opportunity cost of holding the non-yielding asset.

Turning to global demand trends, India’s gold demand in the June quarter fell by 5% compared to the previous year, attributed to record international prices. However, the World Gold Council anticipates a recovery in demand in the latter half of 2024, driven by adjustments in local prices following a significant reduction in import taxes.

Andrew Naylor, Head of Middle East and Public Policy at the World Gold Council, noted, “Despite the impact of high international prices, global demand for bars and coins declined by 5% year-on-year, while jewellery demand saw a sharper drop of 19%.”

In other metals trading, spot silver declined marginally by 0.2% to $27.82 per ounce, while platinum rose by 0.5% to $953.40 and palladium dipped by 0.3% to $900.50.