The gold market has hit an unprecedented milestone as the value of a standard 400-ounce gold bar surpasses $1 million, fueled by gold prices rallying above $2,500 per ounce.

This landmark was first achieved last Friday when gold breached the $2,500 per ounce mark. Since then, the market has continued its upward trajectory, with spot gold recently trading at $2,525.60 per ounce, marking nearly a 1% increase in a single day. Overall, gold prices have surged by more than 20% this year.

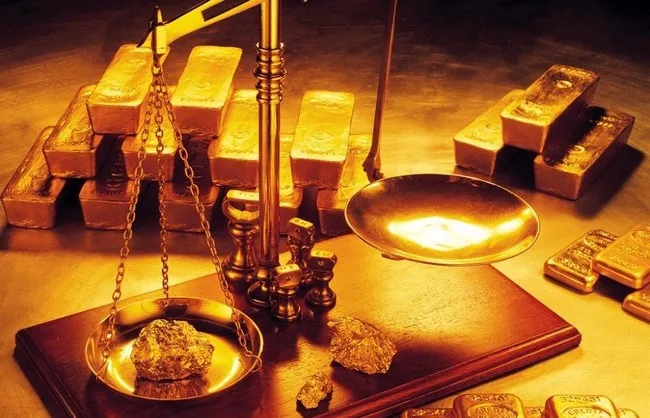

The 400-ounce gold bar, recognized as the industry standard by the London Bullion Market Association (LBMA), now weighs in at approximately 12 kilograms and is worth over $1 million. Known as the Good Delivery Bar, it plays a crucial role in global gold trading and is the preferred form for central banks when storing their official gold reserves. All physical gold transactions on the London loco market are settled using these bars.

Despite its iconic status, there is some flexibility in the specifications of the Good Delivery Bar. According to LBMA standards, these bars must contain between 350 and 430 fine troy ounces of gold, equating to a weight range of roughly 10.9 to 13.4 kilograms.

While a $1 million gold bar may be beyond the reach of most retail investors, demand for the 400-ounce bar has been robust this year. Data from the World Gold Council shows that over-the-counter gold demand has significantly boosted prices, with an increase of over 14 million ounces, translating to roughly 35,000 of these bars.

Additionally, central banks have been major players in the gold market, purchasing more than 17 million ounces in the first half of this year alone, equating to around 42,000 bars.

Market analysts predict that the strong demand from both consumers and central banks will continue to push gold prices to new record highs as the year progresses.