India’s gold loan market is on track for significant growth, with projections indicating it will surpass ₹10 trillion in the current financial year and reach ₹15 trillion by March 2027. This expansion is attributed to various factors, including rising gold prices, enhanced financial inclusion, and increased consumer demand for gold-related products.

Key Trends in the Gold Loan Market

Dominance of Public Sector Banks

Public sector banks (PSBs) are leading the gold loan market, primarily driven by agricultural loans secured against gold jewelry. As of March 2024, PSBs accounted for approximately 63% of the total gold loans, a significant increase from 54% in March 2019. This trend reflects the banks’ strong position and the growing reliance on gold as collateral for loans.

Growth of Non-Banking Financial Companies (NBFCs)

Non-banking financial companies (NBFCs) are also expected to play a crucial role in the gold loan sector, with an anticipated portfolio expansion of 17-19% in FY2025. Over the past few years, NBFCs have maintained a stable market share in the retail segment, although their overall influence has slightly diminished compared to PSBs.

Yield Moderation

While yields on gold loans from NBFCs have shown some signs of growth, they are expected to remain below the peak levels observed four to five years ago. This moderation in yields may affect the profitability of NBFCs but does not hinder their overall growth trajectory.

Growth Drivers of Gold Loans

Several factors are contributing to the robust growth of the organized gold loan market.

Rising Gold Prices

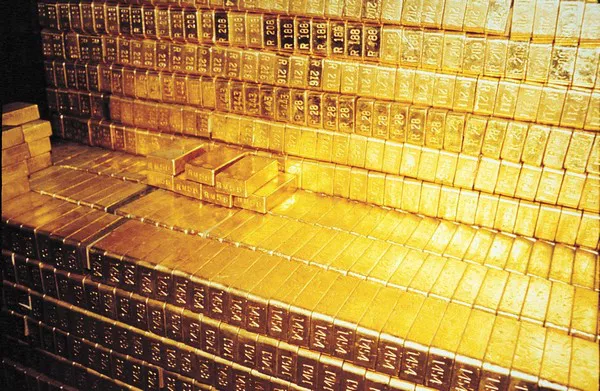

Increasing gold prices have heightened demand for gold loans, as individuals look to monetize their gold assets. As gold becomes more valuable, the willingness to secure loans against it also rises.

Financial Inclusion

The expansion of financial services and improved access to credit have played significant roles in the growth of the gold loan market. More people now have the opportunity to secure loans, even if they lack traditional credit histories.

Consumer Demand for Gold Products

The rising consumer demand for gold jewelry and related products has further fueled the gold loan market. As more people purchase gold for various purposes, the need for loans against these assets naturally increases.

Historical Growth Analysis

The organized gold loan market has experienced a compounded annual growth rate (CAGR) of 25% between FY2020 and FY2024. PSBs have led this growth with a higher CAGR of 26%, while NBFCs expanded their portfolios at a rate of 18% during the same period.

Agricultural Loans: Gold-backed agricultural loans from banks have grown at a CAGR of 26%, reflecting the importance of gold as collateral in rural finance.

Retail Gold Loans: PSBs have also seen their retail gold loans grow by 32% from a lower base, showcasing strong demand in the consumer segment.

As a result, the market share of NBFCs has slightly reduced, primarily because they have focused on retail gold loans for consumption or business purposes.

Market Share Dynamics

Public sector banks have solidified their dominance in the gold loan sector, capturing a larger market share while NBFCs and private banks have seen their shares moderate over the same period. Despite the shift, NBFCs continue to hold a stable share in the retail gold loan segment, reflecting their ongoing relevance in the market.

Future Projections

ICRA, a leading credit rating agency, expects the organized gold loan market to maintain its growth momentum. While banks are likely to continue leading the sector, NBFCs are projected to play an increasingly significant role, particularly in the retail segment.

NBFCs: Adapting to Market Trends

The growth trends observed in the NBFC gold loan sector are closely tied to the performance of other loan products, such as microfinance and unsecured business loans. A. M. Karthik, Co-Group Head of Financial Sector Ratings at ICRA, noted that increasing challenges in unsecured loan markets have led to a resurgence in gold loan growth for NBFCs.

As gold prices remain buoyant, the growth of the NBFC gold loan book is expected to continue into FY2025. Despite modest growth in branch additions and gold jewelry held as collateral, the loan book has grown substantially.

Concentration in the NBFC Sector

The gold loan market within the NBFC sector is notably concentrated, with the top four players accounting for 83% of the market share as of March 2024. This figure marks a decrease from 90% two years ago, as newer players have entered the segment and existing players have diversified their offerings.

Online Lending and Cash Disbursement Restrictions

Entities within the gold loan market are increasingly enhancing their online lending capabilities. This shift is expected to improve operating leverage and expand customer bases. Although new regulations restrict cash disbursements for loans exceeding ₹20,000, the impact on business operations has been minimal. Companies have adapted effectively to these changes, ensuring continued growth in the sector.

Conclusion

India’s gold loan market is poised for remarkable growth in the coming years, driven by a combination of rising gold prices, financial inclusion, and consumer demand. Public sector banks are likely to maintain their dominance, while NBFCs will increasingly contribute to the market, particularly in retail gold loans. As these trends unfold, stakeholders must remain vigilant and adapt to the evolving landscape of the gold loan sector.

Related topics: