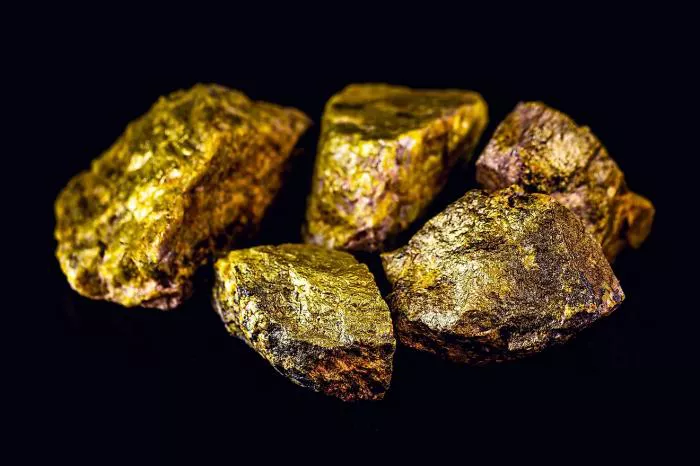

The binding sale and purchase agreement between the two companies will see Koonenberry acquire the Enmore Gold Project, located within the New England Fold Belt, approximately 20 kilometers from the Hillgrove Gold-Antimony Mine, a significant gold resource in the region.

Terms of the Deal

As part of the acquisition deal, Koonenberry will issue 35 million shares to Global Uranium. This exchange marks a key aspect of the agreement, providing Global Uranium with an equity position in Koonenberry and ensuring it retains exposure to the continued development of the Enmore Project. Koonenberry will also conduct a $2 million capital raising to support the project and secure shareholder approval, with a final vote expected in November 2024.

Global Uranium, which currently holds a market capitalization of $21.25 million, emphasized that this sale is aligned with its broader strategy to enhance its North American uranium portfolio. The company has been focusing on its core uranium assets and intends to channel more resources into their development in the coming months.

Andrew Ferrier, Managing Director of Global Uranium, hailed the transaction as a mutually beneficial arrangement that enables his company to focus on its uranium projects, while also maintaining a strategic position in gold exploration through Koonenberry’s portfolio.

“This deal is a significant step forward for Global Uranium as it creates value for both parties involved. While we remain committed to our uranium projects, retaining a stake in Koonenberry ensures that we benefit from the development of the Enmore Project and other gold assets,” Ferrier stated.

Koonenberry’s Share Price Jumps

Following the announcement of the acquisition, Koonenberry’s share price surged by 50%, reaching $0.018 as of 2 PM AEDT. The market responded positively to the news, reflecting growing investor confidence in Koonenberry’s expanding portfolio of gold and copper projects.

Koonenberry, a junior mineral explorer, is focused on discovering and developing gold and copper resources in emerging geological terranes. The addition of the Enmore Gold Project marks a significant boost to the company’s exploration activities in New South Wales, an area known for its rich mineral potential.

Strategic Importance of the Enmore Gold Project

The Enmore Gold Project is located in a region with a long history of gold mining. It boasts a number of high-grade gold assays from historical drilling, rock chip samples, and underground workings. The project also benefits from a well-understood geological model, making it a prime target for further exploration and development.

Koonenberry’s Managing Director, Dan Power, expressed enthusiasm about the acquisition and the opportunity it presents for the company’s growth in the gold exploration sector.

“The Enmore Gold Project offers a near-term opportunity to rapidly advance with drilling, given the exciting historical results and the clear targets we have identified. This acquisition fits perfectly with our strategy of expanding our gold and copper exploration portfolio,” Power said.

The company plans to conduct further drilling at the Enmore site to confirm the historical data and accelerate the project’s development. Given the favorable geological conditions and the proximity to other significant gold resources, Koonenberry expects to make considerable progress on the project in the near future.

Additional Acquisition: Lachlan Project

In a parallel transaction, Koonenberry Gold is also acquiring the Lachlan Project, another key exploration asset located in New South Wales. The Lachlan Project is being purchased from privately held Gilmore Metals, and as part of the deal, Koonenberry will issue 95 million shares to Gilmore Metals.

The acquisition of the Lachlan Project further strengthens Koonenberry’s position in New South Wales, which is home to several highly prospective gold and copper exploration areas. This move also enhances Koonenberry’s portfolio, adding significant strategic landholdings within the Lachlan Fold Belt, a region known for its mineral wealth.

Darren Glover, co-founder and director of Gilmore Metals, will join the Koonenberry board of directors once the acquisition is completed. His experience and knowledge of the Lachlan Project are expected to provide valuable insights into its development.

Dan Power described the Lachlan Project as a strategic addition to Koonenberry’s portfolio, highlighting the early-stage exploration results from multiple targets within the area. “We are excited about the potential of the Lachlan Project, which includes strategic landholdings and promising early-stage exploration results,” Power noted.

Collaboration with Newmont on Junee Project

Koonenberry is also involved in the Junee Project, a joint venture with a subsidiary of Newmont Corporation (ASX). This project has already seen significant exploration work completed, with Koonenberry holding a 20% free carried interest. The Junee Project adds further depth to Koonenberry’s growing portfolio of exploration assets and positions the company well for future growth in the sector.

Focus on Gold and Copper Exploration

The acquisitions of the Enmore Gold Project and Lachlan Project underscore Koonenberry’s focus on expanding its exploration activities in both gold and copper. As a junior mineral explorer, Koonenberry is positioning itself as a key player in the discovery and development of mineral resources in emerging geological regions.

The company’s growing portfolio includes strategic assets across New South Wales, providing significant opportunities for exploration and development. With strong historical data backing the newly acquired projects and a clear strategy for advancing these assets, Koonenberry is set for a busy period of exploration activity in the coming months.

Global Uranium’s Strategic Shift Towards Uranium

While the sale of the Enmore Gold Project marks a shift in Global Uranium’s focus, the company remains committed to its core uranium assets. Global Uranium has made significant progress in its North American uranium portfolio, particularly in light of the growing demand for clean energy and nuclear power.

Andrew Ferrier reiterated the company’s commitment to developing its uranium projects, which have seen rapid progress over the past year. “We are focused on executing our 12-month work program for our uranium portfolio, which is a key part of our growth strategy,” Ferrier said.

The sale of the Enmore Project allows Global Uranium to concentrate on its core assets while retaining exposure to the gold market through its equity position in Koonenberry. This strategic shift reflects the company’s long-term vision of becoming a leading player in the uranium sector.

Conclusion

The sale of the Enmore Gold Project to Koonenberry Gold represents a significant milestone for both companies. For Global Uranium, the deal aligns with its strategic focus on uranium development while maintaining exposure to gold exploration. For Koonenberry, the acquisition strengthens its gold and copper portfolio, positioning the company for future growth in the mineral exploration sector.

With the addition of the Enmore and Lachlan Projects, Koonenberry has secured valuable assets in New South Wales, a region with rich mineral potential. Both companies stand to benefit from the transaction, which sets the stage for further exploration and development in the coming years.

Related topics: