Gold prices remained stable on Tuesday as investors adopted a cautious approach ahead of a week packed with crucial U.S. economic data. Market participants are particularly keen to assess how this data could influence the Federal Reserve’s stance on interest rates, potentially shaping the broader investment outlook.

Gold Prices Flatten Ahead of U.S. Economic Reports

As of 01:56 GMT on Tuesday, spot gold traded at $2,636.50 per ounce, largely unchanged from the previous session. This followed a slight decline of up to 1% on Monday, reflecting a cautious mood among investors. Similarly, U.S. gold futures remained flat at $2,659.00 per ounce.

While gold’s price showed little movement, the U.S. dollar edged higher, making dollar-denominated gold more expensive for foreign buyers. This shift in the greenback’s value added to the market’s wait-and-see sentiment, as investors refrained from making bold moves ahead of upcoming economic reports.

U.S. Economic Data in Focus

Several key U.S. economic reports this week are expected to guide investors’ expectations for the Federal Reserve’s next moves. Among the data points to be released are the job openings report, the ADP employment report, and the all-important payrolls report due later in the week. These reports are likely to shed light on the strength of the U.S. labor market and provide clues about the future direction of monetary policy.

Ilya Spivak, head of global macro at Tastylive, remarked, “It seems we’re just oscillating in one place until a new trigger emerges… Fed rate cut expectations are likely to define what comes next.” He highlighted that the anticipation of a possible rate cut is fueling market movement, with many analysts expecting a 25-basis-point cut later this month.

However, the larger question for investors revolves around the prospects for future rate cuts in 2025. Spivak noted that the market has already largely priced in a rate reduction for the current month. The real uncertainty lies in how the Fed might adjust its stance next year, especially as economic conditions evolve.

Fed Officials Signal Support for Rate Cut

Recent statements from Federal Reserve officials have further contributed to market speculation regarding the central bank’s monetary policy. On Monday, Fed Governor Christopher Waller expressed his inclination to support a rate cut in the coming weeks, citing expectations that inflation will continue its downward trajectory toward the Fed’s 2% target. Waller’s comments added fuel to the growing belief that another rate reduction is imminent.

“I expect it will be appropriate to continue to move to a more neutral policy setting over time,” said John Williams, President of the Federal Reserve Bank of New York. Williams’ statement underscored the Fed’s current approach to gradually adjusting its policy to achieve a more balanced economic environment.

The combination of these remarks has led investors to increase their expectations of a rate cut during the Fed’s December meeting, with the probability now hovering at nearly 75%. A reduction in interest rates typically supports gold prices, as the precious metal benefits from lower opportunity costs and reduced yields on competing assets like bonds.

Gold’s Performance in Low-Interest-Rate Environment

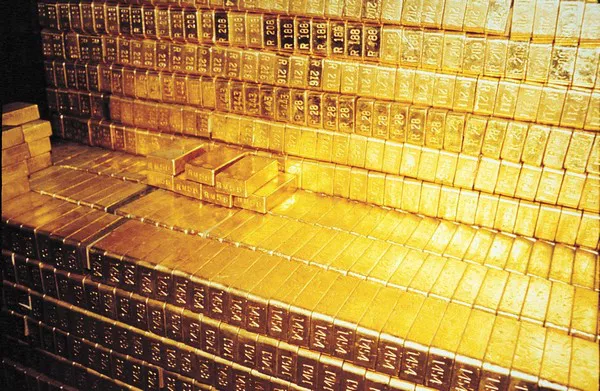

Gold is often seen as a hedge against inflation and economic uncertainty. In particular, the precious metal tends to thrive in a low-interest-rate environment, where the opportunity cost of holding non-yielding assets like gold diminishes. Additionally, geopolitical instability tends to drive safe-haven demand for gold, further bolstering its appeal.

Investors are closely watching the developments in the U.S. economy and the Fed’s response, as these factors will likely dictate gold’s next move. If the central bank proceeds with further rate cuts, it could provide significant support for gold, pushing prices higher in the months to come.

Geopolitical Tensions and Their Impact on the Precious Metals Market

In addition to economic data, geopolitical tensions also played a role in shaping market sentiment. On Monday, the Israeli military launched a series of airstrikes targeting Hezbollah positions across southern Lebanon, escalating regional tensions. Geopolitical uncertainty of this nature can heighten demand for safe-haven assets like gold, as investors seek refuge from potential market volatility.

While these developments added to the sense of unease in global markets, gold’s price remained relatively stable, with investors choosing to wait for more concrete economic signals before making significant moves.

Silver, Platinum, and Palladium Prices

In the broader precious metals market, silver, platinum, and palladium showed mixed results on Tuesday. Spot silver rose by 0.1% to $30.51 per ounce, benefiting slightly from its safe-haven appeal. Platinum, on the other hand, saw a 0.3% decline to $944.35 per ounce, while palladium edged down by 0.2% to $979.72.

While gold remains the most widely watched precious metal, the movement of these other metals reflects broader market dynamics and investor sentiment. Platinum and palladium, in particular, have faced challenges in recent months due to shifts in industrial demand, with the automotive sector—particularly the demand for catalytic converters—playing a crucial role in their price movements.

Conclusion: Investors Await Clarity on U.S. Economic Outlook

As gold prices hold steady, investors are turning their attention to a week of potentially market-moving U.S. economic data. The release of job openings, the ADP employment report, and the payrolls report could offer vital clues about the strength of the labor market and the future direction of Federal Reserve policy.

With expectations for another rate cut later this month running high, the focus will soon shift to the Fed’s outlook for 2025. If the central bank signals further easing, gold prices could see significant support. In the meantime, geopolitical tensions and broader economic uncertainty are likely to continue driving demand for safe-haven assets, providing some cushion for gold prices in the short term.

As the week progresses, market participants will be watching closely for any new triggers that could prompt a shift in the gold market’s current trajectory.

Related topics: